Peak Oil Update - December 2007: Production Forecasts and EIA Oil Production Numbers

Posted by Sam Foucher on December 29, 2007 - 1:00pm

An update on the latest production numbers from the EIA along with graphs/charts of different oil production forecasts. This post is dedicated to the memory of Dr. Ali Morteza Samsam Bakhtiari who passed away last October.

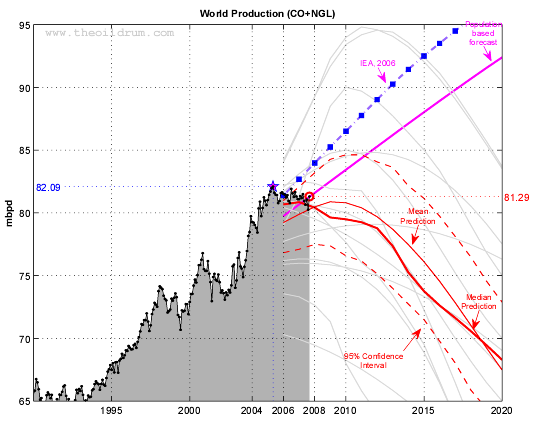

World oil production (EIA Monthly) for crude oil + NGL. The median forecast is calculated from 13 models that are predicting a peak before 2020 (Bakhtiari, Smith, Staniford, Loglets, Shock model, GBM, ASPO-[70,58,45], Robelius Low/High, HSM). 95% of the predictions sees a production peak between 2008 and 2010 at 77.5 - 85.0 mbpd (The 95% confidence interval is computed using a bootstrap technique). Click to Enlarge.

Executive Summary:

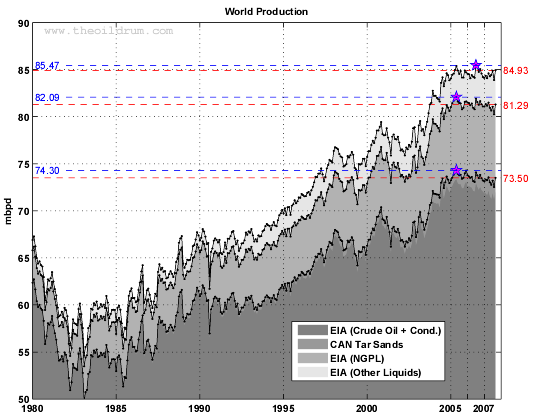

- Monthly production peaks are unchanged:

- All

Liquids:

the peak is

still July 2006 at 85.47 mbpd (revised

0.07 mbpd), the

year to date average production in 2007 (9

months)

is 84.32 mbpd (

0.07 mbpd), the

year to date average production in 2007 (9

months)

is 84.32 mbpd ( 0.04 mbpd), down 0.25 mbpd from 2006 for the same period.

0.04 mbpd), down 0.25 mbpd from 2006 for the same period. - Crude Oil

+ NGL:

the peak date remains May 2005

at 82.09 mbpd (unchanged),

the

year to date average production for 2007 (9

months)

is 80.99 mbpd (

0.21 mbpd), down 0.35 mbpd from 2006.

0.21 mbpd), down 0.35 mbpd from 2006. - Crude Oil

+ Condensate: the peak date remains May 2005 at 74.30

mbpd (unchanged),

the

year to date average production for 2007 (9

months)

is 73.09 mbpd (

0.14 mbpd), down 0.48 mbpd from 2006.

0.14 mbpd), down 0.48 mbpd from 2006. - NGPL:

the peak date is still February 2007 at 8.01 mbpd (

0.02 mbpd),

the

year to date average production for 2007 (9

months)

is 7.90 mbpd (

0.02 mbpd),

the

year to date average production for 2007 (9

months)

is 7.90 mbpd ( 0.07 mbpd), up 0.13 mbpd from 2006.

0.07 mbpd), up 0.13 mbpd from 2006. - Decline in crude oil + condensate continues, however, there is a large increase in crude oil production in September by almost 1 mbpd (largest monthly increase since July 2006). Two thirds of this increase are coming from OPEC. September 2007 estimate for crude oil + condensate is 73.50 mbpd compared to 73.47 mbpd one year ago and 73.92 mbpd two years ago.

- Average forecast: the average forecast for crude oil + NGL based on 13 different projections (Figure above) is showing a kind of production plateau around 81 +/- 4 mbpd with a decline after 2010 +/- 1 year.

Notations:

- mbpd= Million of barrels per day

- Gb= Billion of barrels (109)

- Tb= Trillion of barrels (1012)

- NGPL= Natural Gas Plant Liquids

- CO= Crude Oil + lease condensate

- NGL= Natural Gas Liquids (lease condensate + NGPL)

- URR= Ultimate Recoverable Resource

EIA Last Update (September)

Data sources for the production numbers:

- Production data from BP Statistical Review of World Energy 2006 (Crude oil + NGL).

- EIA data (monthly and annual productions up to February 2007) for crude oil and lease condensate (noted CO) on which I added the NGPL production (noted CO+NGL).

The All liquids peak is still July 2006 at 85.47 mbpd, the year to date average production value in 2007 (9 months) is down from 2006 for all the categories except for NGPL. The peak date for Crude Oil + Cond. remains May 2005 at 74.30 mbpd (see Table I below).

Fig 1.- World production (EIA data). Blue lines and pentagrams are indicating monthly maximum. Monthly data for CO from the EIA. Annual data for NGPL and Other Liquids from 1980 to 2001 have been upsampled to get monthly estimates. Click to Enlarge.

| Category | Sept 2007 | Sept 2006 | Sept 2005 | 12 Months1 | 2007 (9 Months) | 2006 (9 Months) | 2005 (9 Months) | Share | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|---|---|---|

| All Liquids | 84.93 | 84.75 | 84.15 | 84.45 | 84.32 | 84.57 | 84.71 | 100.00% | 2006-07 | 85.47 |

| Crude Oil + NGL | 81.29 | 81.26 | 80.77 | 81.10 | 80.99 | 81.34 | 81.58 | 95.72% | 2005-05 | 82.09 |

| Other Liquids | 3.64 | 3.49 | 3.38 | 3.34 | 3.33 | 3.23 | 3.13 | 4.28% | 2007-07 | 3.81 |

| NGPL | 7.79 | 7.79 | 7.37 | 7.88 | 7.90 | 7.77 | 7.76 | 9.18% | 2007-02 | 8.01 |

| Crude Oil + Condensate | 73.50 | 73.47 | 73.40 | 73.22 | 73.09 | 73.57 | 73.81 | 86.54% | 2005-05 | 74.30 |

| Canadian Tar Sands | 1.30 | 1.22 | 0.98 | 1.34 | 1.40 | 1.07 | 0.91 | 1.53% | 2007-03 | 1.57 |

Business as Usual

- EIA's International Energy Outlook 2006, reference case (Table E4, World Oil Production by Region and Country, Reference Case).

- IEA total liquid demand forecast for 2006 and 2007 (Table1.xls).

- IEA World Energy Outlook 2006 : forecasts for All liquids, CO+NGL and Crude Oil (Table 3.2, p. 94).

- IEA World Energy Outlook 2005 : forecast for All liquids (Table 3.5).

- IEA World Energy Outlook 2004 : forecast for All liquids (Table 2.4).

- A simple demographic model based on the observation that the oil produced per capita has been roughly constant for the last 26 years around 4.4496 barrels/capita/year (Crude Oil + NGL). The world population forecast employed is the UN 2004 Revision Population Database (medium variant).

- CERA forecasts for conventional oil (Crude Oil + Condensate?) and all liquids, believed to be productive capacities (i.e. actual production + spare capacity). The numbers have been derived from Figure 1 in Dave's response to CERA.

Fig 4.- Production forecasts assuming no visible peak. Click to Enlarge.

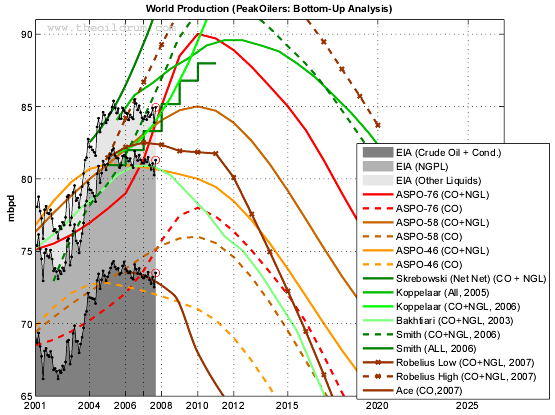

PeakOilers: Bottom-Up Analysis

- Chris Skrebowski's megaprojects database (see discussion here).

- The ASPO forecast from April newsletter (#76): I took the production numbers for 2000, 2005, 2010, 2015 and 2050 and then interpolated the data (spline) for the missing years. I added the previous forecast issued one year and two years ago (newsletter #58 and #46 respectively, in French (sorry about that but the English versions seem to have disappeared)).

- Rembrandt H. E. M. Koppelaar (Oil Supply Analysis 2006 - 2007): "Between 2006 and 2010 nearly 25 mbpd of new production is expected to come on-stream leading to a production (all liquids) level of 93-94 mbpd (91 mbpd for CO+NGL) in 2010 with the incorporation of a decline rate of 4% over present day production".

- Koppelaar Oil Production Outlook 2005-2040 - Foundation Peak Oil Netherlands (November 2005 Edition).

- The WOCAP model from Samsam Bakhtiari (2003). The forecast is for crude oil plus NGL.

- Forecast by Michael Smith (Energy Institute) for CO+NGL, the data have been taken from this chart in this presentation (pdf).

- PhD thesis of Frederik Robelius (2007): Giant Oil Fields - The Highway to Oil: Giant Oil Fields and their Importance for Future Oil Production. The forecasts (low and high) are derived from this chart.

- Forecast by TOD's contributor Ace, details can be found in this post.

Fig 5.- Forecasts by PeakOilers based on bottom-up methodologies. Click to Enlarge.

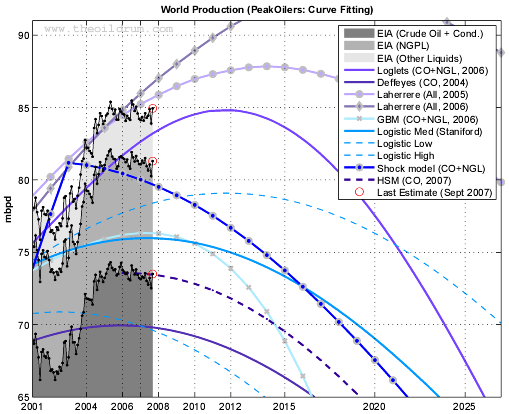

PeakOilers: Curve Fitting

The following results are based on a linear or non-linear fit of a parametric curve (most often a Logistic curve) directly on the observed production profile:- Professor Kenneth S. Deffeyes forecast (Beyond Oil: The View From Hubbert's Peak): Logistic curve fit applied on crude oil only (plus condensate) with URR= 2013 Gb and peak date around November 24th, 2005.

- Jean Lahèrrere (2005): Peak oil and other peaks, presentation to the CERN meeting, 2005.

- Jean Lahèrrere (2006): When will oil production decline significantly? European Geosciences Union, Vienna, 2006.

- Logistic curves derived from the application of Hubbert Linearization technique by Stuart Staniford (see this post for details).

- Results of the Loglet analysis.

- The Generalized Bass Model (GBM) proposed by Prof. Renato Guseo, I used his most recent paper (GUSEO, R. et al. (2006). World Oil Depletion Models: Price Effects Compared with Strategic or Technological Interventions ; Technological Forecasting and Social Change, (in press).). The GBM is a beautiful model that has been applied in finance and marketing science (see here for some background). The estimation in Guseo's article was based on BP data from 2004 (CO+NGL).

- The so-called shock model proposed by TOD's poster WebHubbleTelescope . You can find a description of his approach on his blog here as well as a review on TOD. The current estimate was done in 2005 based on BP's data (CO+NGL).

- The Hybrid Shock Model is a variant of the shock model described here. The forecast is based on EIA data (up to 2006) for crude oil + condensate, the ASPO backdated disovery curve and assumes no reserve growth and declining new discoveries.

Fig 6.- Forecasts by PeakOilers using curve fitting methodologies. Click to Enlarge.

| Forecast | Date | 2005 | 2006 | 2007 | 2010 | 2015 | Diff2 | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|---|---|

| All Liquids | |||||||||

| Observed (All Liquids) | 84.63 | 84.60 | 84.39 | NA | NA | 2006-07 | 85.47 | ||

| IEA (WEO) | 2004 | 82.06 | 83.74 | 85.41 | 90.40 | 98.69 | -1.02 | 2030 | 121.30 |

| IEA (WEO) | 2005 | 84.00 | 85.85 | 87.64 | 92.50 | 99.11 | -3.25 | 2030 | 115.40 |

| Koppelaar | 2005 | 84.06 | 85.78 | 86.61 | 89.21 | 87.98 | -2.22 | 2011 | 89.58 |

| Lahèrrere | 2005 | 83.59 | 84.47 | 85.23 | 86.96 | 87.77 | -0.83 | 2014 | 87.84 |

| EIA (IEO) | 2006 | 82.70 | 84.50 | 86.37 | 91.60 | 98.30 | -1.98 | 2030 | 118.00 |

| IEA (WEO) | 2006 | 83.60 | 85.10 | 86.62 | 91.30 | 99.30 | -2.23 | 2030 | 116.30 |

| CERA1 | 2006 | 87.77 | 89.52 | 91.62 | 97.24 | 104.54 | -7.23 | 2035 | 130.00 |

| Lahèrrere | 2006 | 83.59 | 84.82 | 85.96 | 88.93 | 92.27 | -1.57 | 2018 | 92.99 |

| Smith | 2006 | 85.19 | 87.77 | 90.88 | 98.94 | 98.56 | -6.49 | 2012-05 | 99.83 |

| Crude Oil + NGL | |||||||||

| Observed (EIA) | 81.46 | 81.33 | 81.02 | NA | NA | 2005-05 | 82.09 | ||

| GBM | 2003 | 76.06 | 76.27 | 76.33 | 75.30 | 67.79 | 4.70 | 2007-05 | 76.34 |

| Bakhtiari | 2003 | 80.24 | 80.89 | 80.89 | 77.64 | 69.51 | 0.13 | 2006 | 80.89 |

| ASPO-46 | 2004 | 81.00 | 80.95 | 80.80 | 80.00 | 73.77 | 0.22 | 2005 | 81.00 |

| ASPO-58 | 2005 | 81.00 | 82.03 | 83.10 | 85.00 | 79.18 | -2.08 | 2010 | 85.00 |

| Staniford (High) | 2005 | 77.45 | 77.92 | 78.31 | 79.01 | 78.51 | 2.71 | 2011-10 | 79.08 |

| Staniford (Med) | 2005 | 75.81 | 75.94 | 75.97 | 75.52 | 73.00 | 5.05 | 2007-05 | 75.98 |

| Staniford (Low) | 2005 | 70.46 | 70.13 | 69.71 | 67.92 | 63.40 | 11.32 | 2002-07 | 70.88 |

| IEA (WEO) | 2006 | 80.10 | 81.38 | 82.67 | 86.50 | 92.50 | -1.65 | 2030 | 104.90 |

| Koppelaar | 2006 | 81.76 | 82.31 | 83.68 | 91.00 | NA | -2.65 | 2010 | 91.00 |

| Skrebowski | 2006 | 80.95 | 81.47 | 82.64 | 87.37 | NA | -1.62 | 2010 | 87.97 |

| Smith | 2006 | 80.53 | 82.81 | 85.45 | 91.95 | 88.60 | -4.43 | 2011-02 | 92.31 |

| Loglets | 2006 | 81.12 | 82.14 | 83.02 | 84.65 | 83.26 | -1.99 | 2012-01 | 84.80 |

| ASPO-76 | 2006 | 77.92 | 79.00 | 81.35 | 90.00 | 85.00 | -0.33 | 2010 | 90.00 |

| Robelius Low | 2006 | 81.45 | 82.19 | 82.50 | 81.84 | 72.26 | -1.47 | 2007 | 82.50 |

| Robelius High | 2006 | 81.45 | 84.19 | 86.67 | 93.40 | 92.40 | -5.65 | 2012 | 94.54 |

| Shock Model | 2006 | 80.76 | 80.43 | 80.01 | 78.27 | 73.74 | 1.01 | 2003 | 81.17 |

| Crude Oil + Lease Condensate | |||||||||

| Observed (EIA) | 73.81 | 73.54 | 73.14 | NA | NA | 2005-05 | 74.30 | ||

| ASPO-46 | 2004 | 72.80 | 72.56 | 72.25 | 71.00 | 63.55 | 0.88 | 2005 | 72.80 |

| Deffeyes | 2004 | 69.94 | 69.93 | 69.84 | 69.02 | 65.99 | 3.30 | 2005-12 | 69.95 |

| ASPO-58 | 2005 | 73.00 | 73.80 | 74.65 | 76.00 | 69.50 | -1.51 | 2010 | 76.00 |

| IEA (WEO) | 2006 | 70.80 | 71.78 | 72.77 | 75.70 | 80.30 | 0.37 | 2030 | 89.10 |

| CERA1 | 2006 | 76.49 | 76.89 | 78.60 | 82.29 | 83.83 | -5.47 | 2038 | 97.58 |

| ASPO-76 | 2006 | 71.11 | 72.10 | 73.66 | 78.00 | 72.00 | -0.53 | 2010 | 78.00 |

| HSM | 2007 | NA | 73.56 | 73.53 | 72.82 | 69.53 | -0.39 | 2006 | 73.56 |

| Ace | 2007 | NA | 73.48 | 73.03 | 66.96 | 58.47 | 0.11 | 2006-01 | 73.55 |

Next update probably in March.

Previous Update:

September 2007June 2007

February 2007

January 2007

December 2006

November 2006

October 2006

September 2006

OilWatch last issue:

The Hybrid Shock Model, Bakhtiari (R.I.P.), and Ace still rule the roost. And the IEA predictions look more and more ludicrous with each passing month.

Some predictions were made recently, eg ace made his good guess in 2007 for 2007. Why not show both month and year the prediction was made, useful even for predictions made in 05/06.

Great work showing all this data, Bakhtiari continues to look very good, particularly considering his guess was made way back in 2003... tho if he continues to look good our little raft is just about to go over the falls.

Er.... so what happened to the new all-liquids peak that was discussed here a couple of weeks ago?

Sorry if I'm being a bit thick - is it just that the figures have been revised, or Khebab uses different sources for his data?

Thanks, Chris

The new peak for October (all liquids) is based on the IEA data for which the front month is November, see Stuart post for an in depth discussion:

Does the latest IEA number matter?

The problem with the IEA is that they give only limited public data (only the three last months) and it's difficult to track revisions whereas the EIA can revise its monthly estimates up to three years.

The EIA Short Term Energy outlook (STEO) has also preliminary estimates for October and November:

October: 85.96 mbpd

November: 85.61 mbpd

Trailing v Forward

The world's cereal stocks to use ratio

is even farther behind the curve.

http://www.investmenttools.com/futures/soy/chicago_wheat_futures_market.htm

That IEA (Monthly Oil Market Report) peak for November 2007 (86.55 mb/d) - in comparison to the July 2006 peak (86.13 mb/d)- has been created by:

(1) an extra 180 kb/d of processing gains - freshly added in the December 2007 monthly report

(2) an additional 310 kb/d (=460 kb/d - 150 kb/d) bio fuels

Sep was strong on account of 300k/d higher other liquids vs 9 month avg... I wonder if this is seasonal? How does this item compare with previous sep vs previous years?

No, it's not seasonal, most of the increase (two thirds) is coming from OPEC (mainly Saudi Arabia and Iraq).

September 2007 estimate for crude oil + condensate is 73.50 mbpd compared to 73.47 mbpd one year ago and 73.92 mbpd two years ago.

Thanks Khebab.

The second graphic links to the wrong version on clicking for the full size version (eg: Crude at 73.50 in the embedded graphic, but at 72.51 in the fullsize version.

Cheers,

--J

Looking at EIA data (IPM table 1.1a) Azerbaijan is down from 910 kbpd in July to 567 kbpd in September. Field maintenance or what have I missed?

Bahktiari GBM and Staniford

Shock Model = Black Swan

Outstanding work, Khebab

You're in the History books.

Khebab,

Many thanks as ever for a very useful post. Looking at the all liquids world production data as a plot of all liquids world consumption, what would be your estimate, of what worldwide production/consumption would have been had unlimited oil been available at the $20-$30 per barrel range?

Just looking at the curve, mine would be, that without the effect on demand of sustained price increases (oil last crossed the $40 per barrel in mid 2004), current worldwide consumption would be about 90 mb/d.

On this basis, the impact of price on demand would be about 5 mb/d, i.e. about a 5% reduction at the present time, co-incidentally just enough to keep consumption essentially flat over the last three years. As you have underlined, during this time there has been an overall increase in overall consumption by the net oil exporters. Could you quantify that overall consumption increase for the main net exporters for the period mid 2004 to end 2007 ?

This means that the ‘rest-of-world’ consumption must have dropped during these three and a half years, by the same amount.

To the extent that this reflects a reduction actual rest-of-world demand, depends on the extent to which we are seeing any rationing. There has been no reports of a major decision by a government to institute formal, sustained rationing, due to a decision to no longer ‘afford’ access to fuel based only on market forces at world prices.

We have however seen some rationing (clearly in the case of Iran, somewhat messily in China ) in countries where fuel prices are subsidised. There have also been a number of reports on TOD of fuel shortages due to local refining capacity shortages, and due to failure of third world distributors to acquire supplies in good time.

All in all is seems to me that, at the margin, decisions are being made to restrict access to fuel, and that therefore there is some, perhaps small amount, to which current rest-of-world consumption is now less than inherent demand.

Homo Semi-sapiens

So, does the 2006 EIA data show any evidence that demand by the largest users of oil is actually falling let alone keeping up with 1.8% growth per year required for BAU – who, if anybody, amongst top 15 consumers is being priced out of the market?

The 15 countries with the greatest demand consume ~60% of the world’s oil but ~80% of net exports.

In 2006 only 4 of the top 15 were growing consumption of oil – China, India, Germany and Singapore.

Of these 15 largest consumers only 4 import less than 90% of their needs – USA, China, India and Thailand – all the rest are very dependent on net exports. Total liquids net exports fell by -3.3% from 2005 to 2006.

According to Henry Groppe interviewed by David Strahan here:

http://globalpublicmedia.com/groppe_iea_oil_spike

the decrease in demand has come from industrial applications. He sees industrial uses dropping sufficiently over 2008-09 to maintain normal prices. Things will get interesting in 2010.

This would explain the price drop in late 2006 which did not correspond to any additional supply. The Chinese especially are using a lot of oil for industry. Of course, they are now substituting coal for oil which is not good news for GW and pollution levels.

There is still a lot of trucking that can be moved to rail and barge as well.

Good interview. I hope he is right.

Just an observation-

everyone knows (or should) that theoildrum is a band of volunteers... we do this analysis and post it for free so humanity can collectively better allocate scarce resources and plan for mitigation and adaptation to scenarios not adequately provided by corporate and government leadership.

Forget the general public for the time being - how long will it take for the investing and corporate decisionmakers to see that 'free' analysis by the 'peak oilers' listed by Khebab above have been dramatically more accurate than the (very) high priced forecasts of CERA and the increasingly marginalized IEA/EIA forecasts?

I'm not trying to stir the pot or win a popularity contest -I am genuinely interested in the answer to that question - can rhetoric, reputation and marketing really trump accurate forecasting in perpetuity?

Nate: My guess is that by 2011 we will be 6 years post peak and at that point the CERA types will have substantially changed their tunes. In the period 2008-2011 Jeff Rubin, Matt Simmons and a few other analysts will gain increasing credibility (IMO)-so by maybe 2011 the timing of peak global oil supply will be agreed to by almost all analysts. I have heard Matt Simmons credit the experts at TOD but most MSM analysts will just jump on board in the next few years (claiming that they knew how this would play out all along).

As long as the rhetoric supports a desired market, rhetoric will trump. When the market changes, the rhetoric changes.

There are levels of investment and corporate decision-makers. IMO, those at the extreme top are very much aware of more accurate forecasts. What is said publically is different than what is said privately, however--and those at the top let others speak for them.

Yes, it most certainly can, and does! I have been banging the drum to some of the people I know who invest in energy to cough up some funding for ASPO and TOD because their forecasts are obviously far better than the utter hooey being peddled by the official agencies and "respected" prognosticators such as CERA...to little effect. Most of them can't even understand the difference, or see the need for funding for the former. Even after I explain it, they sort of shrug and say oh well, that just means there is an investing advantage for those few who pay attention to the ASPO/TOD/etc. analysts.

Some day soon I hope to create a subscription service that will give the better analysts on the scene a proper platform, and proper compensation, for their excellent work, and change all that. Nothing would make me happier than cutting checks to the TOD brain trust.

I think the problem is mainly human habit. People will believe those they know personally, and those who bear some official stamp of approval, before they'll believe some unknowns in the blogger community, even if the latter's work is better. Why? Because they're too lazy to really get their heads around it and see the difference for themselves, so they rely on the familiar and the official. I have heard some amazingly ignorant perspectives on energy and peak oil from the mouths of otherwise educated, aware and wealthy individuals, which were based entirely on something some trusted friend of theirs said to them....and they are remarkably resistant to information that doesn't conform to their existing worldview.

You can lead a man to information, but you can't make him think.

But for those of us who like to think, Khebab's work (and that of the unpaid, unbiased analysts he covers) is a priceless gift, one for which I am eternally grateful.

Sometimes I wonder if we would be taken more seriously if we charged money for subscriptions. Money is seen as evidence of value. People assume anything that's free is worthless.

Like that restaurant that couldn't sell an appetizer for $5, but sold out when they priced the same thing at $15.

But thats just a symptom of the problem we are trying to solve. Most people have chosen to abandon critical thinking. So the choose not to evaluate the facts. I have no problem with people that claim global warming is false based on their own analysis the point is they actually spent some time to do critical analysis on a problem. One of the big reasons we are in the mess we are today is because people don't use their critical thinking skills. Charging money does not really solve the problem.

Thats why I'm not so excited about attempts to solve the major problems we have looming. The underlying problem is on of social failure. In some cases rooted in behaviors from the dawn of time.

My opinion is man is doomed to the rise and fall of empires and the underlying overexploitation of his environment for a lot longer. This did not start with the oil age and it won't end with the oil age. At best we might make a few painful steps forwards. We have thousands of years of past mistakes that we have learned something from and thousands of years to mull and live with the oil age.

Sometimes it helps to take a very long view. I think we are at a turning point in history that will reverberate for centuries just like the fall of Rome. But in the end its just another big event that at best warrants a few chapters in future history books.

It comes from the nature of personal will. If our will is to solve a problem to maximize personal benefit (the egoic will), we create the paradox of the commons. Something fundamental has to change in the will for it to ignore the personal in favor of a common good. Oddly, though, such notions sound quaint. It's as though homo sap is an experiment gone awry--or a genetic branch that will be pruned over the millennia.

Wile we are talking about psychohistory, New Scientist recently ran an article about procrastination (paywalled), based on research by Piers Steel. (ITWire link http://www.itwire.com/content/view/15805/1066/).

His conclusion:

The formula is U = (E x V) / (I x D), where U is the desire to complete the task.

This encompasses several factors of human behaviour we have discussed before. The main factors I guess are perceived Value and Immediacy.

But I think this type of equation also describes behaviour at a governmental level. It is a good fit to why the USA procrastinates on Global Warming, for example.

In business, the ratio V/I describes the driver for the typical "crisis management" style of most middle management. When a problem becomes both urgent and important, they fix it, otherwise it is left. "Not on the radar".

I wouldn't necessarily say prioritising the immediate problem is a failure, in most cases this is a sensible strategy. The upshot is though, that PO will not be generally regarded a major problem until it is really in everyones face. The best we can do is accumulate evidence for E, V and I.

I think IEA and even CERA already have changed position from what has gone before. CERA set out as being opposed to PO, but they effectively agree on a plateau. I think they realised they had to address PO in order to be credible. In doing so, they have put PO on the table.

It might seem like free analysis falls on deaf ears, but I believe that journalists and investors do pick up on it, and it does have an effect.

My family cared for my schizophrenic brother for five years as he slowly died from cancer. We had no expectation of success. It certainly was not pleasant. It was horrendous on all of us and caused my parents to divorce. Yet the care continued. There was no social reward or desire to continue.

Sometimes we do things for the sake of others without benefit to ourselves--the S variable. My sense is that there is a lot of S at TOD.

Many families care for terminally ill members at great expense. It is done for selfish reasons. They would like to be looked after if they became ill or got injured and of course in old age.

The question is, will those same family members care for a terminally ill stranger at personal expense?

Altruistic behaviours are very rare maybe non existent if examined closely enough.

"To the person wearing shoes, the world is covered in leather." (I don't know who said that, but it seems appropriate here.)

The failure of our educational, academic, spiritual, financial, and governmental systems is the exponential increase in the belief that the egoic-will (doing things for personal benefit) is the only game in town.

I used to think like this. Read the Selfish Gene by Richard Dawkins. Altruistic behaviours do exist. It is call kin selection.

How can kin selection be described as altruistic? Just the opposite in my estimation.

As far as I know I have read all of Dawkins' publications.

He touches on altruism in The God Delusion.

I repeat when examined closely enough there is NO altruism in human behaviours or in any animal behaviours for that matter. (That I am aware of).

You sound like you don't have many true friends.

Even Apes have altruistic bahavior. When gorillas get old and sick, the healthy ones will bring the sick one food. This behavior has been documented on dicovery channel.

They do it because of conditioning, just like mother ducks look after their chicks.

The apes behaviour evolved with natural selection.

The behaviour is related to survival of the species and therefore the individual.

Do you think that they should let the old, sick and injured die of starvation to be non altruistic? Which sort of community do you think would have the best chance for survival?

The old can play a part in the community and the sick and injured recover and assist the community.

Obviously religious people have difficulty with the evolution of behaviours because it places primates and humans in the same category as just another life form and excludes their god in human development.

So you can accept it or not. I don't want to argue with religious zealots trying to defend their beliefs.

I wouldn't call anyone a religious zealot just yet. It is a common assumption in the greater western world that humans are fully conscious, rational beings, that we have free will to control our actions. And anything that suggests that our unconscious moves our hand in daily dealings or that there are primitive forces within us that influence us is deemed a blasphemy by both religious and so called scientific rationalist people. Since modern science is essentially mechanistic and does not make value judgements, the values that guide both religious and non-religious people are the same baggage from western education system, essentially pseudo christian ones.

A true friend is indeed worth many altruistic actions. Unfortunately altruism doesn't exist. What exists is a perception, the outer appearance to the actions we perform because of specific reasons other than absolute-unselfishness. Behaviour evolutionists find many advantages to us from having friends, where as species biologists argue that it is good for the species as a whole.

The illusion of altruism is maintained for our benefit. It makes us feel good about it and cuts down any doubt or convoluted rationalizing that we otherwise would have to make every time we are faced with a situation where we make choices to help out others. It is preprogrammed behaviour to feel this way towards our kin: our immediate family, our relatives, our tribe (friends). Nationalism and group think further extend this but rely on rather weak social games to make us think that for example every citizen of a country or every employee of a company is kin to us.

By the way its Dawkins' own fault that nobody reads his books. He's an ass. So smug and annoying about everything he sais that nobody wants to listen to him. And he hasn't actually developed any of his ideas to any conclusions. So to me he remains just another ego maniac peddler of pseudo manifest destiny for our brilliant civilization and limitless man.

Before Dawkins wrote about God, he wrote some of good books on evolutionary behaviorism. Go read the Selfish Gene, which talks about kin selection. Or go to wikipedia. Altruism isn't an illusion; it has been scientifically observed and described.

One can only choose to abandon what one has in the first place. Unfortunately my experience with teaching my offspring such skills has been that when he attempts to use them he is often ostracized by his peers from the schoolyard. Though he does get straight A's in science and math.

Hi FMagyar,

"Ouch."

re: "...ostracized by his peers". Something that might (emphasis) help, check out some of the work pertaining to schools and kids at www.cnvc.org.

Leanan. You may be right, and I would be willing to pay (something, I am on SS) for the excellent work done here. But there is a certain paradigm-shifting ethic at work here that the world would profit from immensely if it were recognized and spread.

I don't want to charge money for content. I hate that model, actually. I just strongly suspect that we'd get more respect if we charged for our reports like CERA does.

For respect, tell people what they want to hear. Do not challenge any assumptions that underlie their sense of self-worth, or their place in the pecking order. Do not make them fell bad. People gladly pay for information of this sort.

But they also pay for pretty doomerish stuff. Stratfor, for example. They make some pretty radical predictions. Most of which haven't come to pass. Yet people keep paying them.

One of the principals at Stratfor wrote "The Coming War With Japan", which did not come to happen, but was a very interesting and entertaining book. Kind of prepared me for the same fuss over China later.

I loved the discussion about the logistics of Japanese imports.

There is a model where you don't charge for the content. As an example there could be a paid subscription for a monthly brochure/PDF which would contain an intro into PO, an intro into it's analysis and the latest stats for that month. As long as it looked authoratitive and expensive, there would be loads of busy people wanting to subscribe to it. Just like the 15 dollar appetizer. Back issues could be free and downloadable from TOD site and all the same content plus discussion would still be available at TOD site.

this might be the place to bring up Lewis Hyde, The Gift again. http://www.randomhouse.com/catalog/display.pperl?isbn=9780307279507

I believe that virtually all art and all scientific discovery happens in the "gift economy", and then those discoveries and that art is distributed to the larger population by the "market economy." They operate independently of each other, and are always suspicious of each other -- but both are necessary -- the problem occurs when "gift" and "market" get out of balance, as has happened in our own time, and the "market" overwhelms and cannibalizes the "gift".

http://southerncrossreview.org/4/schwartz.html

The Oil Drum is firmly rooted in the "gift economy", even though its members clearly participate, and draw their sustenance from the "market" economy. Transferring TOD to the market would simply destroy it -- no one would profit, but many would be bereft.

Thank you all for tremendous work, and may everyone have a prosperous New Year despite unraveling of our established order.

Hello,

I think you would be taken more seriously (which is sad, but I have run into the same dilemma concerning language courses).

But it should not be an immediate subscription, because people must first read enough to become hooked, like me.

If it would help TOD and keep the info flowing, I would pay a few euros a month. That strikes me as normal and fair because I have learned trainloads here.

Ciao,

FB

Lazy is a funny kind of word.

Many people are quite energetic and yet we call them "lazy" because we ourselves are too lazy to dig deeper and unroot the real underlying causes.

Understanding Peak Oil requires many cognitive skills. Not everyone has those cognitive skills. Some people can't read maps. Some people can't read graphs or charts. Some people can't follow the math. Laughing at them doesn't help. It doesn't give them the cognitive skills they lack.

funny, you were too 'lazy' to add your trademark image on the right of your post....;)

I'd rather be lucky and lazy

than an energetic smart ass like some folk. --Gump

P.S.:

I never did understand them graphs and charts much.

Jenny helped me with the hard hard math.

Then I bought stock in a California fruit company.

Then I bought stock in a California company where they Go and Oogle over each other.

Then I bought stock in an Arizona Sunshine company.

Lazy is as lazy does.

--Gump

Good point. I tend to be a little overcritical that way. --C

duplicate deleted

duplicate deleted

"You can lead a man to information, but you can't make him think."

I want to you for that concise description of the main problem people like Albert Bartlett have faced for decades.

Nate asks,

"how long will it take for the investing and corporate decisionmakers to see that 'free' analysis by the 'peak oilers' listed by Khebab above have been dramatically more accurate than the (very) high priced forecasts of CERA and the increasingly marginalized IEA/EIA forecasts?"

Well, if someone does decide to charge a fee, I would suggest that they not use the type of chart as the one labeled above:

Fig 5.- Forecasts by PeakOilers based on bottom-up methodologies. Click to Enlarge.

There are so many scenarios there that one of them has to be right! :-)

Either peak yesteryear, peak within a matter of two years, or any interval on out to past 2030, depending on how you read it.

I am often astounded that CERA can get the kind of money they do for peddling what is essentially rumor and glossed up news that is available everywhere.

CERA knows about as much as the rest of us about oil reserves and when pontential "bumpy plateau" or what some call peak will occur, that is to say, essentially nothing.

They are just better at selling it.

Very interesting is a chart like the one above labeled:

"Fig 1.- World production (EIA data). Blue lines and pentagrams are indicating monthly maximum. Monthly data for CO from the EIA. Annual data for NGPL and Other Liquids from 1980 to 2001 have been upsampled to get monthly estimates. Click to Enlarge."

Note that if we go backward, we see at least 4 or 5 "bumpy plateaus" at least as noticable in retrospect as the one we are seeing now, which is so marginal as to be essentially "measurement error". The truly legendary "psuedo peak" was in the late 1970's to early 1980's of course. What is interesting to me is that at the time of these flat production periods in prior years, no one noticed!

The age of second by second watching of oil production, like the age of second by second watching of and investing in stocks, futures and commodities is a very recent thing. In the old days, oil production could go up or down, and no one knew it anyway unless an emergency occured.

And very few true emergencies ever did...oil production seems to be a process a bit like making sausage (or laws as a well known pundit once said)....best not watched if you want to enjoy the finished product!

There is another way to look at this....just as some historians now see the two world wars of the 20th century as essentially one war with a lull between them, it is possible to take the long view of peak and view it as one continuing emergency that began in the 1970's, and lulled in the 1980's through early 1990's, and then returned to emergency status at the turn of the new century. Kunstler's "Long Emergency", but much longer than even most peakers realize. The question then becomes, exactly how long of a game are we playing here? If the long emergency last for another several decades as it has for the last three, many boomers wouldn't care, because death would remove them from the scene and their offspring would have to deal with it. Sounds cold, but it's true.

we would now ask what caused the lull in the long emergency of the 1980's/90's?

The North Sea may have provided a false sense of security as did the abnormally low consumption situation created by legacy conservation from the 1970's (I know people who still swear by late 1970's/early 1980's houses as the best for being insulated, warm and cozy, and the cars were small and compact in weight for several years before the SUV boom!).

The other factor that is often forgotten is the collapse of the U.S.S.R. In one of his presentations, Matt Simmons mentions that factor as delaying the consequences foreseen in "The Limits Of Growth" by The Club of Rome, and thus undermining the credibility of the "limits" movement.

Needless to say, the above view only creates more confusion (as if such a thing were possible!), because it stretches out the time period that must (or should) be analyzed carefully. That is to say, it may be one minute to midnight, but we can't see the clock, and don't know when the clock started running. We could be very early in a long game, very late in a short game or any combination of the above.

Given the confusion, we are back to square one: All one can do is hedge, and not the modern "hedge fund" type of hedge, but real hedging, i.e., diversify, search for non oil based alternatives and renewables, and stategic storage to mitigate short term instability. "Case harden" the culture as insurance, and otherwise, try to avoid disrupting the stability of the culture. In a nation of aging people who really have few alternatives anyway, creating panic could accelerate catastrophe faster than the system could have otherwise adapted to it.

As much as I would wish that someone would pay the TOD volunteers for their excellent study of the oil and energy situation, and for their reasoned and sober advice, no one will pay me for mine! :-)

Looks like it's a labor of love for all of us... :-)

RC

Yes, sadly but true as Leanan notes above, money is an indicator of quality. This is true for almost all goods and services sold, the more expensive car, house, tv set, it-consultant, the better it has to be. Never mind the facts that you might buy a perfect well-maintained house for $20.000 in the outbacks while paying ten times the amount for a run-down apartment in the inner city, or you could buy a russian Lada 4x4 for 1/10th of the amount a Porsche Cayenne SUV costs, where the Porsche is thirstier, worse in terrain, paced with failure-prone electronics, etc.

I don't think there's a more complicated explanation to this than that we're so hammered with messages since decades ago that a materialistic lifestyle is one to strive after. Since we (in the western world) all became wealthy enough to buy a car and a tv set long ago, our means of showing our success is to buy more expensive goods and services, to show that we're better off than our neighbor. Hence money equals quality, and CERAs analysis is more worth than the free ones you can find here on TOD or other PO sites.

I think that the precious flat periods were noticed, but not by the general public. Shurely there were meetings with "important people" 30 years ago when oil production was flat or declining, but no-one outside those circles were informed or cared. The internet has brought an obscene amount of information to almost anyone, a kid with one of those $100 laptops in a poor country could take part of the same information as we do, and as EIA does. I consider this information revolution generally very good but it also has downsides, like markets panicing when stock, oil prices, cunnrecies or whatever dips a bit. Dips that essentially aren't that important but gets exaggerated and overblown by analysts, traders, et al.

Thoughtful, but I don't think it's the right way to set a timeframe on this (or other) chrisis. The WW2 was between 1939 and 1945, and WW1 was an event that lead to it, not a part of the WW2. Just as the current plateau is a current event, and we've arrived here because of events in the past, doesn't make the past events as a part of this plateau. If you apply this long view to everything you could define the cause for every car crash as the invention of the wheel, 4000 BC, or why not the Big Bang that set off the whole universe that lead to this car crash. I think one has to define causes as causes, and events as events, so the current "long emergency" beings about now, and what happened in the 70's was pre-leading causes.

Happy new year to all!

WWI was a war between rivals fighting over resources, WWII had those rivals fighting a war against their own working class. WWII was the West against Russia, with one of the rivals annexing most of the others (except Britain) to enable it to fight a war against another (Russia) to the maximum extent possible. America intervened and shut the war down by providing the proponderance of power to the divided side (Russia and Britain) against the united side (everyone else in Europe, basically).

America doesn't care who rules Europe, as long as no one does.

um, didn't you neglect to mention germany ?

I don't think your brief portrayal of WW I and WW II is very accurate. Here's my alternative one-minute version.

WW I was not primarily about resources, but rather about European power politics gone out of control and exascerbated by an arms race and interlocking alliances. Rivalry and pressure had been building for decades and finally blew the lid off a period of fragile peace.

WW II (in Europe at least) was essentially WW I, The Sequel, largely caused by Germany being a highly resentful sore loser of WW I and humiliated by the punishing terms of the Treaty of Versailles. German extreme nationalism combined with the Nazi's vision of a resurgent German empire caused German to turn eastward and attempt to conquer Russia. France and Great Britain were to be just minor annoyances to get out of the way before enacting Hilter's grand scheme. The rulers of the US couldn't stand seeing their chums, the Brits, get beaten and so sided with Russia and Great Britain against Germany, even though Stalin was at least as big a monster as Hilter. The result of WW II is that it made the world safe for communism and

created a bi-polar world power structure: US vs Russia.

Furthermore, I am not sure I understand what you mean about the rivals fighting against their own working class. The basic class structure in the west and in Russia was pretty much the same after WW II as it was before. So, I don't see WW II having much effect in that regard. As in all wars, WW I and WW II were primarily fought by the working class.

Indeed. Selection bias is one of my very favoritest failures of reason. Primarily because even the smartest people I know fall for it over and over again.

Exactly! I am not worried about corrupting the extremely independent-minded analysts of TOD, and I have no doubt that their research would be far better than the other reports available out there, especially if intentionally packaged up for a particular paying audience.

I am firmly convinced that we just need to spend a little effort marketing it.

Dear Nate,

The questions you raise are profound, and the answers are very complex and go right to the heart of our modern culture.

A simple answer is that we have all become consumers roaming a vast, global, market-place, rather than active citizens participating in a functioning democracy. Actually, that isn't a particularly simple answer, and requires a lot of qualification, only I'm off to a party soon, where I have promissed not to utter the PO word!

But I suppose my analysis applies more to the general public, rather than the 'elites' who should know better and more, because better and more knowledge should translate into power and money at some stage.

I've found that 'intelligence' and the ability to understand and use knowledge are pretty much evenly distributed among societies various social groups. Access to elite positions in most societies is not based on intellectual ability, that is we don't live in a meritocracy; but is actually based on social class, and classes tend, for the most part, to recruit members almost exclusively from their own class. This narrows there cultural perspective considerably. For example, one can examine the way people are recruited to positions of power and influence in the City of London. It almost resembles a 'caste' based system, and even those lucky few who don't come from the right families are forced by the selection process to exhibit and internalize the values of the ruling elite. But enough of that.

Dissident or heretical views are rarely greeted with smiles by people in power, especially if these views clash with the interests of power elite, even if it's in their objective interests to examine and reform the system they control and benefit from.

Historical parallels to our current situation are myriad and not particularly positive. Why didn't the French aristocracy react and institute reforms before the Revolution in 1789? Why didn't Spain choose to become a modern state, instead of decline and humiliation? Sliding from the world's most powerful and richest empire into a backwater lasting two hundred years? The same question could be asked about China. Why didn't China choose to change, rather than allow foreigners to virtually take the country over and 'colonize' it?

These are vast questions, controversial, with many potential answers.

The short answer is Power, not education, or knowledge, or democracy; but Power. Who has it, and who does not. It wasn't as if the Chinese didn't know what reforms had to be introduced in order to defend the country against foreign intervention, however, the vital and necessary reforms also threatened the power and status of the old ruling-class who because of their priviligded position in society were protected from the worst consequences of foreign intervention and competition. They opposed reforms, reforms that threatended the established social order, even if objectively and paradoxically, reforms and modernization was probably the only chance they had of maintaining any semblance of the old order. Through 'class enertia' they chose to go down with the ship they knew, rather than change course and risk losing power and control.

After all this history, one can't help but wonder if the American ruling-class will prove to be just as narrow-minded and inflexible, and unwilling to institute profound, structural change, as the ruling elites in China and Spain?

Writerman: You are making the common mistake of looking at everything from a nationalistic viewpoint, which the MSM encourages. Far from being narrow minded or ignorant, the American ruling class, their family, their friends, all the people that matter to their tribe, do FAR better letting the USA slide. Gasoline at $25 a gallon is a disaster for suburbia, but there is no evidence that $25 a gallon gasoline will stop the relentless growth in the number of global billionaires. My point is that the pain of oil depletion will not hit the real decision makers for a long time yet (IMO).

"Gasoline at $25 a gallon is a disaster for suburbia"

that depends on so many factors. is that a disaster if it happens in a year? yes. five years, yes. ten years, I don't know. beyond that, who knows?

John: IMO, what people forget is that even suburbanites who can afford gasoline costs might decide to change their lifestyle so as to lower their gas expenses. The trend is that when gasoline hits $25 a gallon, probably a 50" HD Plasma will cost less than a fillup of the tank ($450).How many suburbanites will happily fork out $25000 a year for gasoline alone?

"How many suburbanites will happily fork out $25000 a year for gasoline alone?"

ok, let me say a few things here. I believe that peak oil is real and probably we're 2 years or so into it. I think the suburbs will have trouble. now, let me defend the suburbs a bit.

1. suburbs could be safer than living in the cities because the criminals won't have enough money to get out there.

2. the suburbs often have higher incomes. some will lose their jobs, but overall they will have a bit more resources and maybe knowledge(if someone is in business or works in finance) to get through peak oil.

3. there is still lots of land in suburbia. I've driven in suburbs that are 10 houses on each side with houses that are setback maybe 15-20 yards, sometimes more. lots of room to garden. you'll probably have to fill-in the pool unless you can store water in it. if people in the cities can grow food on their roof and balcony(or porch) how much food can suburbia grow?

4. suburbia is often right on the edge of farming country. for suburbia, that's a good thing. not all suburbs are like that. if you lost your job you could still find hard work on a farm or make an arrangement to grow some vegetables or have a cow on your neighbor's farm.

5. suburbia is often surrounded by farms. I've been out in the middle of nowhere and seen a typical suburb in the middle nowhere. lots of land.

how close to the city do you want to be? lots of people can mean crime and possibly riots if it all goes bad. walkable for you and walkable for criminals!

the thing is, people adapt wherever they are. nobody knows how peak oil will play out. we could just have a repeat of the 70's.

It is often my experience that unadulterated research (ie research for the sake of research) is often the most accurate. Once an outside source throws money at you, your research becomes a 'vested interest' and is, therefore, subject to manipulation based on interest bias.

Actually the truth is generally the best research is preformed by embezzling funds from projects approved and funded by vested interests to perform real research. In fact I suspect if you look most of the biggest breakthroughs would require the scientist that accomplished them to be jailed for misuse and fraud and other serious accounting crimes regarding research funds.

The most famous case of this that I can think of is Watson and Crick discovering the structure of DNA. Crick was a graduate student at the time and Watson was on a fellowship. Neither of them were funded to work on that project, in fact they had been asked not to work on it, but did it anyway.

Another good example is Colin Campbell who was paid, for many years, as an oil executive to tow the company line. He had to retire before he could pursue honest research on the subject of peak oil.

"can rhetoric, reputation and marketing really trump accurate forecasting in perpetuity?"

the NAR is certainly trying on the housing side. my guess is that the general public is just not listening to CERA and therefore doesn't remember it's been wrong.

At this point the CERA report seems laughable. I have a good friend who works for a huge investment bank. Having done some professional and personal interest research on oil supply, I sent him an email in 2004 talking about the high risk of both a tightening supply and a peak in conventional oil in the very near future. I also sent him a list of sources including a number of expert reports on the issues of peak oil and tightening supply.

He categorically ignored me. When prices initially rose, he blamed speculation and surging demand. When prices stayed high he stuck to the party line. When the CERA report came out, he cited it as evidence that supplies would continue to increase. At this point, he's admitted the sources I pointed to were correct in predicting a price rise but still has his head in the sand on the issue of peaking in the near future.

What's most shocking to me is that we seem to have reached a peak/plateau in conventional and liquids production NOW (2005-2006 time frame). Even ASPO placed the projected peak date at 2010. The economic factor of surging prices which was, at least, supposed to delay the peak date seems to have failed to open up significant new reserves and the net discovery rate has continued to decline. IF this is true, we are in a state of emergency right now, though only a few of us have realized it.

I for, one, hope the peak date is a little bit further on. But, looking at things from an analytical perspective, each month oil production fails to make significant gains in the face of roaring prices makes peak oil seem more and more todays reality and not some artifact of a remote doomsayer's future.

Very concerned at the moment...

"can rhetoric, reputation and marketing really trump accurate forecasting in perpetuity?"

Yes! I have watched it go on for decades.

It only ended because the individual in question retired. Now that they are gone, it is starting to leak out why it went on. Basically, upper management didn't understand the subject and did care about the problems being caused. The problem didn't affect their paychecks so they just said "screw it".

Too long. ;(

If the IEA and EIA are on the money with a Peak in 2030 (stop giggling, you lot in the back row! ;) ) we need to get started right now if we're to have any chance of maintaining our current way of life and avoid the usual unpleasantness associated with resource collapses (I personally would like to keep the Rule of Law intact and functioning, even if I don't have a job. I could always get a job with the cops, as they'll have plenty to do ;) )

If some of the more pessimistic models are correct, we're already as much as fourteen years behind the 8-ball (if you assume we should have started the transition ten years before peak), and at best, 'only' seven. In which case, we're stuffed, and we'd better start re-learning how to garden in our backyards, buy a bicycle, stop being Good Consumers, and start making our own strategies for 'survival' (I own some land close to tranport and town hubs, my Girlfriend and her family are buying land out Bush, so we've got Options right off the bat).

Of course. Consultants are hired to agree with management, not accurately predict the future.

It would be helpful to add dated forecasts from IEA adn EIA to the actual production.

The one from IEA 2006 shows how unrealistically the data being fed to policy makers is.

Perhaps the sailfish fin of projections over the top of reality would help clarify that policy makers are operating on poor assumptions.

I wonder when the general public (mainstream media) will start showing these charts and trying to project forward.

For global warming, this year was the first year I started to see serious repetition of the famous Mona Loa trend chart (see http://www.esrl.noaa.gov/gmd/ccgg/trends/ )

I'm guessing that within a few years pundits will be showing the Peak Oil "trend chart" whenever energy prices come up.

Any speculation on when that recognition will occur? I would guess if we drop below 82-83 million barrels of oil per day (or we see a significant price spike perhaps).

The education needs to happen, and it needs to happen soon. I would hate for us to go through a recession, see a drop in consumption, a corresponding drop in price, and for everything to forget about it. (even if we start dropping production -- It'll just be related to the recession, and not to peak oil).

Mike

How to explain peak oil to the general public in terms they understand in as few words as possible:

$25 a gallon gas by 2020

Assumptions: If liquid production remains steady until 2010 we can expect at least a 10% increase in price, which is what we have seen over the last two years. If liquid production starts dropping 2% a year after that the annual price increase will double to 20% at least. These are conservative assumptions.

The idea that gas could reach $25 a gallon in the next decade just boggles the mind, especially since most of us remember less than $1 gas.

I usually prefer to describe it as $4 next year, $5 the year after that, then $6, then $7, then $8, etc... Obviously, accuracy of prediction is not paramount here, but I think you need something more immediate than 2020 to get their attention.

or $ 0.25 gas.

My Dad remembers paying $1 to top off the tank.

I don't think we can make any such projections. Predicting supply is far easier than predicting demand. There are so many unpredictable factors that can affect the latter that I don't believe prediction is possible, beyond the broadest general outlines over fairly long periods of time. E.g., I would be more confident in predicting energy supply/demand 50 or 100 years on than the next 10.

Sometimes I think the best thing to do is forget about it.

I'm 65 years old. When TSHTF I'll probably be dead. Why waste time thinking about a problem most aren't interested in and which few can do much about. But then it's so fascinating I can not resist.

Peak Novelty....

Another expression of "interesting times"?

Hello Practical....I am 65 too. Us old folks don't do good with heat and cold. We frequently perish from heat stroke or hypothermia. Where do you live? I think you should care! A lot can happen in the next 15 years.

pilot

I am 74. Take care of beef herd (currently 29). Raise large garden. Put up own hay,2223 bales 2007. Lead local PO group.

Last 26 days helping neighbors recover from devastating flood in Lewis Co. WA.

My advice work hard every day and teach young people every day. Us depression babies have a great mission ahead of us. Hang in there.

Geez Practical. I can't believe that give up and die comment. Both Airdale and I are 69 and we're out there busting our asses doing real country work. A week ago I felled a 70' fir for next year's firewood. I'll buck it up and split it as soon as the snow melts. I had to chain up the 4x4 car yesterday just to get down our private mountain road. I'm ordering stuff for next year's garden.

I mean, really, I can't envision people, regardless of their age, just throwing their hands up.

Todd

Now that's just awesome! My hat's off to you Todd. I hope I'm able to do the same at 69.

Your comment gives me great hope! My husband and I are both in our early 50s just bought 13 acres of black dirt "muck" soil and plan to grow vegetables to sell. We've both been feeling a little "old" to be starting on this quest but the amount of support from nature that we have gotten for this endeavor is humbling. We have two teenage boys who currently don't have much interest in "farming" but will nonetheless be compelled to help out. I lived on a farm in Illinois in which we raised beef (which I do not eat) and I was glad to escape this rural life when I moved to New York City after college. My mother finds it quite humorous that I am now returning to my "roots." If it wasn't for TOD, I'm not sure I would. Although, we've hedged our bets and continue to straddle both worlds: we own a condo in Hoboken, a house on 3 acres 60 miles from NYC and now 13 acres of black dirt not far from out home.

Interesting Q of why we in the US are oblivious of the peak oil situation.

Might be that it takes a long time for things to sink in, especially when matters are rather complicated. Many people watch Matt Simmons being interviewed on CBNBC and think, "Well, how about electric cars? What about all the new oil finds? Brazil, Alaska, Chevron Jack, the Caspian, Canadian tar sands? What about solar, ethanol, wind, geothermal? What about fusion or even antimatter? And what about the fact that people waste so much energy, now, and could cut back painlessly?"

It might take awhile for the harsher realities to become incontestible. It might take $15 gasoline for people to really feel the seriousness of this, at which point, we might be well past peak.

Meanwhile, elites in the US might not want to create an acute public awareness of the oil problem while the US is trying to consolidate whatever hold it has on existing world supplies. Think Iraq.... And consider that Qatar has more natural gas reserves than the US, Canada, and Mexico combined.

And that Iran has amounts similar to Qatar's. You see why the US feels it has to stay in Iraq. And that even if Hilary or Obama becomes president, he or she too will go along with the program. (I doubt that the ruling elites in the US would allow any president to abandon Iraq. )

Well, that's my take on it. It's hard to know what's really going on. But there might be a political aspect to this well as technical considerations.

Oil at $15/gallon is still a bargain, compared to what you would have to pay a man to do the same work. Think what it would cost to pay a pair of loggers with a whipsaw to cut a tree, vs. how much you would pay in gasoline to run a chainsaw.

The future is obviously going to be more human and animal power, probably a lower population, and likely everyone will move more slowly. Not all bad, in my opinion. And not necessarily terribly disruptive getting there -- the TeeVee will tell people how to behave to make the transition.

I think you make a excellent point. Although even in the case of a chain saw electric power can substitute for oil. But the key is that power would be valued and used where it accomplishes real work and benefits. Although true this is not relevant to our current society which is built on using power to accomplish a increase in frivolous consumption.

Next on chain saw vs human power I'd not assume that the two are not competitive since wages can drop to subsistence levels. For all intents and purposes slavery. Especially today given that the human would be competing with the chainsaw for work. At the low end of the scale wage arbitrage is between man and machine.

Not necessarily slavery. Call it full employment. You can give a man a saw to keep him busy, with a sense of self-worth. Not so long ago China was building highways with tens thousands of workers, each handed a hammer, with which to make the needed gravel by pounding on roadside rocks.

What do you mean "even"? I've had an electric chainsaw for years. It was cheaper to begin with than the gas-powered ones. Works great and I've cut down many trees with it.

but speak, the grid can't handle everyone using an electric chain saw!

how long of an extension cord does one need for commercial logging?

you're living in a dreamworld where liquid fuels are easily replaced

"Oil at $15/gallon is still a bargain, compared to what you would have to pay a man to do the same work."

I have been thinking that too. how much would gas have to cost to get me to sell the snow blower? probably a lot. it would cost $10-15 to have kids do it. more for professionals. the answer depends on how much snow there is and how heavy it is. gas would probably have to be a lot to give up on the snow blower. even then I could cut back. shovel what I could, even deep snow. when I was younger I made $15-20 a snowstorm per house.

the cost to run the lawnmower isn't that great either so the cost there would have to be high.

Here in Finland the market for snow blowers is almost zero. We rather enjoy slowelling snow. It's relaxing, an excuse for adults to 'play' with snow like they used to in their childhood and for most office workers the only time they get to do anything physical whole week.

Electric chainsaws on the otherhand are just ridiculous. For them the market is also almost zero since people consider them toys. I mean 99% of the stuff you do with a chainsaw is out of reach for mains electricity. And the power just isn't the same. Neither is long life or maintainability.

Lawnmowers are mostly mechanic or electric. Again you see mechanical push type lawnmovers being used by people who seem to enjoy doing stuff in their gardens. People don't like noisy and smoke belching machines in their gardens anyway. It's only the people who have a dynasty-like house and two mercedes at their driveway that somehow are obliged to have a motor driven lawnmover.

So there are large cultural differences in the world. And you USians seem to have many unique home grown problems. The rest of the world will be a lot better off then you when PO happens.

Seriously, I think the real problems with how valuable oil is to us will be seen in the industries that run our world. In agriculture industry, transportation and manufacturing. A lot of commodities we take for granted will become luxury items or will simply ceased to be produces. Cheap energy has oiled our world for too long and we have simply forgot how expensive or tedious doing stuff is without it.

Take for example forestry. You have to cut down trees and transport them to the mill to make lumber or pulp for paper. It used to be that you had a group of two dozen lumberjacks doing 18 hour days six days a week working on a logging site, with horses hauling the logs out of the woods to the river to be floated down to the mill. When the chainsaw was invented and trucks started to hault the logs straight to the mill, it is said one modern lumberjack could do ten times his fathers work. Now it is said that modern harverter machines have again made ten yesterdays lumberjacks obsolete.

So to afford to replace a harverter with men, you'd have to have oil price go up an order of magnitude atleast (with multiplying effects bringing the harverter operating cost to a x100) or have wages cut by a similar order of magnitude. Here in Finland we still have our native breed of a horse that was specifically bred to do agricultural and forestry work, hauling logs from the forest for example.

I'm looking forward to changing my hightec job for a log driver. I rather like horses. Computers not so much...

Finns certainly do enjoy the 6 week vacations in Bali - hard to get that A380 across the oceans without oil.

If you read my comment again, you'll notice my intention was not to praise Finns eco-whatever-ism. My point was that different countries have wildly different attitudes towards such things as the essentialness of electric chainsaws for example and these things aren't written in stone that you absolutely have to have a snow blower.

We Finns certainly do flaunt our consumerism now more than ever before at the height of a long economic boom. All of that success has been made in the international markets, while domestic production and dependancies have been torn down and outsourced to the world. We eat central european food, heat our houses with russian gas and design products to be manufactured in China. So, you don't have to envy us when the PO comes. We'll be screwed too.

Agreed - but global untaxed jet fuel is something we all share. Note that China is actually lowering the duties on imported refined products as of 1 Jan - having the Beijing airport run short of fuel for the Olympics would not look good. 80% of my daily 1,000,000 Kcals of energy consumption is in jetfuel - no chainsaws in my McMansion, either, so I guess we also have that in common.

Hey Ransu, I'm surprised by your comment that electric chainsaws are "just ridiculous".

I have 2 working (and many dead) petrol (gasoline) powered chainsaws, Stihl 24 inch bar and Husqvarna 18 inch bar, but I still have a great deal of use for my crappy Chinese electrical chainsaw with a 14 inch bar.

I use the petrol powered machines out in the forest, on farms, in riverbeds, at the beach, etc, but only to cut timber to the size that I can load on to my trailer.

I then take the logs/billets/branches home and use the small, light-weight electric machine to cut them to usable size. This I do by moving the logs to a saw horse at waist height and cutting so that the the bits fall into a wheelbarrow for moving to the stack or the splitting block. I have a bad back (broken 12 years ago) so I am unable to spend long periods using a heavy petrol chainsaw at various heights. The lighter, much quieter electic unit makes it possible for me to cut most of my firewood requirements. I also get more of the sawdust at home to add to my compost and mulch.

A final advantage is that in todays crazy economy, it is cheaper to buy a new "throw away" Chinese electric chainsaw than to have my quality petrol chainsaw serviced (new chain and sparkplug, carby flush, etc).

Cheers

Merv

The issue of oil energy in the future will not be cost!

The issue will be availability!

In net importing countries the governments will allocate who gets oil and in what quantities. First priorities will be for food, housing, military & health care system, and even those will have to optimize for efficient usage. All other users will be deemed nonessential and will have to fight over the drops remaining.

Market system will not rule for energy, just as the market did not rule during the depression for jobs and food supply. The government stepped in during the depression to control markets for food, financing and employment. Similar government control of the economy (markets) will take place a few years after peak oil. Some may call it communistic, but most will see it as survival mode for one's country.

It will be some time before we know how predictions for 2010 turn out, but 2008 is here. I realize that the curves have the data for 2008/9, but pretty hard to interpolate. How about publishing numbers for these two years?

TIA

I have a question on that first CO+NGL production graph.

What is the longest period of time, in the past 10, 30, 50, 100 years... between production peaks when production has declined for more than a few months?

For example... on that graph there seem to be three periods.

(approximately)

1990-1996: 67mbd

1998-2000: 73mbd

2001-2003: 77mbd

and now... 2005 - ? @ 82mbd

We could have been having this same discussion in 1990... yet 6 years later, off to the races we go. You don't need to convince me of anything, I believe Peak Oil has either happened or is within a year or two of happening... but I just want to establish another checkmark that we can use to say...

"*ah* never before have we experienced this long a period of decline in production."

I always say it's the combination of production declining with prices rising. If the prices were falling, that would explain the production cuts.

That's rather a bad angle to use to explain PO to people. Reminds me of the endless arguments over GW, how this year was warmer than ever before and so on. It's an indicator that something extraoridinary is happening, and with enough statistics a propability for it can be calculated. But this is not very convincing in the end.

Much better approach is to explain why PO is happening. Explain how oil is produced, what the limits and bottlenecks are. Explain how oil is consumed and how dependent we are of it. To illustrate your points, tell of histories of particular oil field depletions and countries peaking.

When people 'get' the idea why oil is peaking, that PO is 'real', that it is inevitable, then you can start to discuss specific statistic indicators on how PO is currently proceeding. Otherwise you're just surrendering the argument over to the endless tit-for-tat anecdote game that GW discussion was stuck on for years.

I think this is an interesting point. How unusual is the current plateau from a historical standpoint, when one takes a variety of other factors into consideration? Have we ever seen a plateau/decline this long in a climate of increasing demand, global expansion and increasing price? Or is the current era unique?

The current plateau is not the longest, 1990-1996 was the longest but prices were around $20 at that time. Today prices are near record high as well as rig counts. However, oil inventories are still in the upper range. If inventories drop significantly and OPEC does not increase production that could be a sign that we have in fact reach peak production. The trick is that we are observing only oil production (which is following closely oil consumption) and not production capacity. Peak oil means that peak production capacity has been reached (i.e. no spare capacity).

Thank you for the excellent work you do in analyzing oil production and related phenomena. Your work gives us laymen the tools to understand a complex subject. When one becomes so wrapped up in a study, it is often difficult to deal with the lack of attention paid to such an important issue by our leaders and the public at large. There is a reason we often can't hear the warning tocsin.

Most species fit into very tight ecological niches, but humans are a generalist species, and, as such, we prefer extensive utilization of resources over intensive. This is an evolutionary survival tool built into our nature. It's why we colonized the globe so rapidly, it's why stopping immigration is impossible, why we look for more oil rather than become more efficient. When forced into it, we can adapt and come up with new systems. Agriculture was our solution to the paleolithic population explosion. Innovation, just like speciation, comes out of stress. Human society experiences punctuated equilibria, to borrow a term from the late Stephen Jay Gould. It would be better if we could problem solve before we go over the falls, but that may not be possible. Inertia is powerful.

Paradigm shifts tend to come from people operating out of the loop, ones who are not invested in the status quo. Fifteen years ago, at a composites conference, I sat next to the director of advanced engineering for GM. I told him that if he wanted a paradigm shift in the auto industry, he should hire some farmers, since farmers solve engineering problems all the time, but most haven't been to engineering school and, therefore, don't know the "right way" to solve a problem. They come up with their own solutions that work.

Politicians operate behind the curve. They're rarely leaders. Large corporations, like automobile manufacturers, have difficulty changing direction. Changes will come, but they will come from directions we don't expect. Solutions will arise out of distributive creativity. There will also be pain, there is no doubt of that. But as the Catholic monk Thomas Merton noted, pain is a function of the process of healing.

Here in Mankato, Minnesota, we're in the process of organizing a Peak Oil Task Force to help our community prepare for the coming crises. We will be analyzing exactly how we use energy and developing systems to make conversion to a sustainable lifestyle possible. Social problems demand social solutions.

Post of Day (or Week)

Good luck in Mankato..

Hi Fred,

Yes, good luck. And I hope you'll write up your progress for the "TOD: Local", so we can hear about it (and learn something).

For anyone that wants to give to the worthy cause of informing the public about Peak Oil, APSO-USA is trying to build an endowment so that they can have a couple of full time staff members rather than being 100% volunteer. They have put out this appeal for donations.

TOD is not affiliated with ASPO but both are working toward the same goal. As many TOD'ers will know, ASPO put on a terrific annual conference in Houston with 500+ attendees, pretty much all with volunteers.

Randall

Randall: Thanks for putting that out there. I was remiss in not doing so myself. ASPO is as worthy a destination for donation as any.