Home Buyers Demand Short Commutes, Efficient Homes (with Backyards, Parking, Lots of Square Feet)

Posted by Glenn on December 6, 2008 - 12:12pm in The Oil Drum: Local

Given the recent run-up in energy prices, subsequent spike in foreclosures resulting in a full blown credit meltdown and financial crisis, I thought it would be interesting to check in with American home buyers and see what the latest data said about their motivations to buy. Not surprisingly it's a mixed bag. There are a lot of good intentions out there for shorter commutes, energy efficient homes and other environmental features. But often these are overcome by the lure of getting more "home for the money" far away from mass transit options and having a detached home in the suburbs.

If the Obama administration wants the next wave of home buyers and developers to make better decisions about what types of homes to demand and supply, they will need to wade into the arena of community land use decisions.

According to a new survey of home buyers by the National Association of Realtors, Commuting Costs and Energy efficiency were of primary importance in selecting the homes and apartments they eventually purchased.

Commuting costs factored greatly in neighborhood selection, with 41 percent of buyers saying they were very important and another 39 percent saying transportation costs were somewhat important. “Since fuel costs began rising in the latter part of the survey period, it’s reasonable to assume they’ve become even more important to home buyers since,” Yun said. “We’ve heard from our members that commuting costs are playing a bigger role in buyers’ decisions.”Environmentally friendly features also were important, cited by 90 percent of buyers. Heating and cooling costs were of primary importance, followed by energy efficient appliances and energy efficient lighting.

However, does this mean that the era of the single detached suburban home is over? Far from it.

Seventy-eight percent of all respondents purchased a detached single-family home...Fifty-five percent of all homes purchased were in a suburb or subdivision.

Based on a Zip Realty Survey on housing features that would eliminate a property from consideration for a buyer, the most frequently cited features are Lack of Garage (72%), Low Square Footage (52%), Small Yard or Lack of Outdoor Space (41%).

Local community land use policy is most often shaped by NIMBY concerns of current residents wanting to avoid any development that might place strains on their police, education, social service budgets or that might increase traffic congestion. Rarely are high minded ideas of creating more efficient living arrangements or denser mixed use areas in presently residential-only areas of single detached houses.

When you are in a hole like the current housing and financial crisis, the first move should be: Stop Digging. Stop building new subdivisions of automobile dependent residential only development.

My view on a good peak oil aware land use policy is that suburban communities are going to have to make a simple choice:

1. Urbanize to become much more efficient with energy on a per capita basis

2. Ruralize to maximize production of food and energy (solar, wood, etc)

Federal and State governments have a major role to play in resetting the incentives around land use. Since roads are often created and maintained with state and federal money rather than local, this could be the lever that best makes sure that Suburban sprawl does continue.

Funding formulas for road projects versus mass transit could be dramatically reset to favor communities that have higher percentages of people that commute by other modes than automobiles. What if a community had to spend a minimum of 20%-35% of their state and Federal transportation dollars on mass transit? Or what if any community that received transportation funding from state and federal sources had to prove that they have a plan to reduce vehicle miles traveled (VMT) by single occupant vehicles or increase the average efficiency of cars on the road?

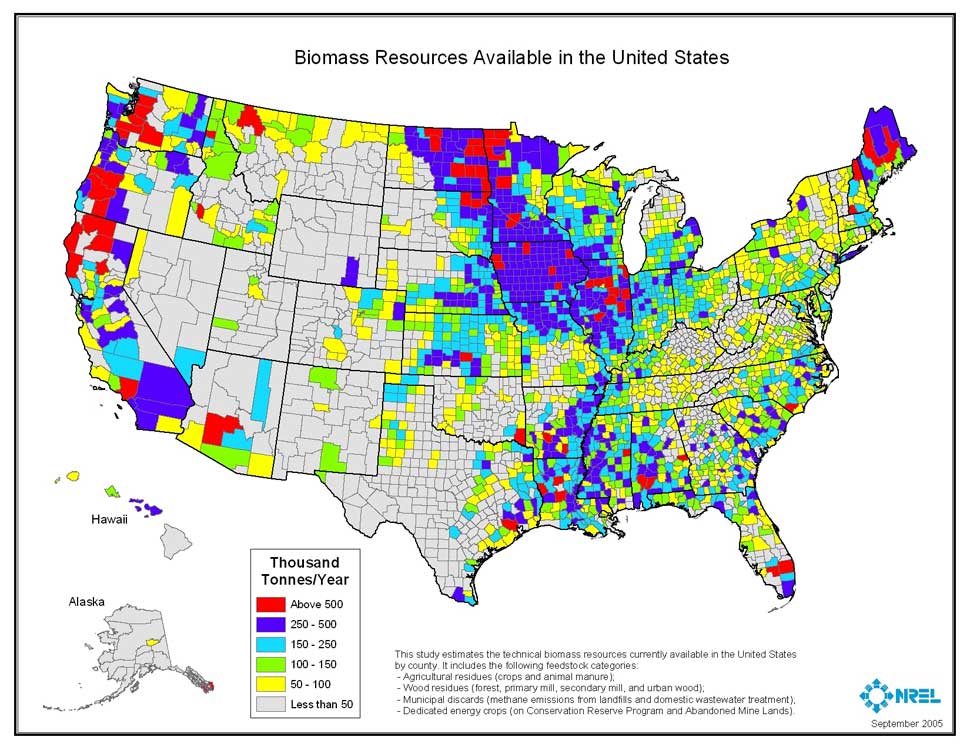

Similarly, I think there should be incentives around food production that could also stimulate the incentive to ruralize or at least get more people to start backyard gardens--what if you could write-off any purchase of seeds and non-landscaping garden equipment? The basic idea would be to reward higher production of either lower energy intensive crops or biomass for heating fuel. I'm sure others could come up with lots of ideas.

On the demand side, the nationalization of Freddie Mac and Fannie Mae also allows the Federal government to put into place better calculations of the impact of transportation and energy costs into how much mortgage they are willing to extend to new home buyers in urban vs. suburban areas. Urban areas tend to have much, much lower transportation and energy expenses--if those are factored into a 30-year mortgage loan decision, there could be a 20-30% increase in the loan amount depending on if the home/apartment is located in an urban area versus a suburban one.

But I think a good start would be to have state and federal governments help communities make better decisions regarding their long term land use policies, instead of the current short sighted and NIMBY driven policies that encourage the over production of inefficient and low production suburban housing. Long term planning at the local level is something that is only done when it is forced upon it by an external entity to get funding. State Governors and the new Obama administration can stimulate this planning by tying Federal funding to it.

And maybe the next crop of home buyers will have more choices of much more efficient urban homes or more productive rural homes.

You talk about urban vs. suburban areas. How do you make the distinction?

I live in a suburb of Atlanta. I find it hard to believe that our in-town areas are all that different from the suburbs in the amount of energy use. Our businesses are scattered throughout the metropolitan area, so commuting "downtown" isn't something very many do, unless they work in government offices, one of the downtown hotels, Georgia Tech or Georgia State University. Most of the homes, even very close in, are single family homes, on separate lots. The older homes are probably poorly insulated. Public transportation is iffy, even in the closest locations. Sidewalks are not generally available, so if you do take public transportation, you have to deal with not having sidewalks to walk to the public transit. Also, buses generally don't run on Sundays.

I don't think very many live apartments. If they do, they are probably almost as likely to be living in apartments in the suburbs as the city. Likewise, the percentage of residents using public transportation in the city is likely pretty low. There are buses in the suburbs as well. Using public transportation in either the city or suburbs requires a lot of diligence.

Is your urban model primarily New York City, and a few Eastern cities, or are you thinking about cities that aren't all that city-like?

In this study, Atlanta is the #4 US city on the sprawl index out of 83 cities. The score is lowered by less compact housing, a poorer mix of homes and jobs, poor street connectivity, or weaker than average town centers.

Thanks Gail - yes my model is the classic urban area before before development centered around the automobile - New York, Boston, Philly, San Fran, Chicago and many other cities have retained much of this infrastructure. I think many cities that I've visited like Atlanta, Houston, Dallas, have strayed so far from that urban model that they are nearly just a collection of suburbs with only a very small classic urban core. Walkability (usually a good combination of pop. density and mixed use development is a major key to any urban area's efficiency, as is small square footage apartments in attached buildings. If it's not walkable, it's suburban. If you can grow a surplus of crops beyond your family's needs, then that would be a good definition of rural. Suburbs are neither efficient with energy nor productive enough agriculturally.

How far can you walk in 20 minutes--a mile?

Typically walkability is defined as less than 600 foot distance to motorized transport.(OTH, bicycles do extend that considerably, though they compete with cars on the street.)

When you say 'walkability' you really mean walk PLUS mass transit, so this ends up as suburban and mass transit are mutually exclusive, a fine bit of circular reasoning.

A lot of 'walkability' issues obviously are related to zoning and there are areas in cities zoned for residences which keep retail or business use a good distance from a residence. This happened because people wanted to keep their homes away from the 'streetscape'.

By your definition, would those areas suddenly become suburban? Most zoning codes neatly segregate residences from commercial or industrial property and getting variances is very difficult.

Mass transit serves a small minority of the population(far under 50%) in every US city except overpopulated New York City and every seat is subsidized.

Many people dislike the noise, smell and dirt of cities and decided to move to suburbs despite miserable commutes to miserable jobs.

Given the Internet, flex-time and a less secure job environment,things like telecommuting, satelite offices, part-time or a three day work week more do-able and save some energy for commuting(which amounts to just 15%(!!) of total miles per households--45% goes for shopping, 27% for visiting friends/recreation)).

You're talking a lot about consumer wants & preferences.

I'm saying that those are going to change very quickly. I think most suburbs will either get busy urbanizing for efficiency (mixed use zoning, mass transit, increased density) or get busy producing as much food & energy as possible.

Otherwise, they will become the ghost towns of the 21st Century.

I find this interesting as a Canadian. Canada has it's share of urban sprawl, though you tend to find it in newer cities in the west (especially smaller centers).

But what about smaller towns? I lived in a small town of about 6000 for 3 years. Excluding the drive to work, I found I could walk everywhere. Obviously, I didn't walk to get groceries once a week, but I could walk to my pub, walk to the cafe, walk to the farmers market. IT was only getting to work that requires a car.

I've always defined a city by it's downtown. The reason that Manhattan or Toronto are such wonderful cities is because they have a vibrant urban core with kick ass transit. One can live without a car quite easily

I've mentioned this some time ago, but I lived car free for 6 years in a city of 300,000. Moved to the city centre and used the bus for work. Is that not possible in America ?

There are a lot of small towns that are totally walkable. The problem recently IMHO has been that town centers have let commercial development crowd out residential areas and/or people have fled the centers of downtown areas as rents, housing prices and crime went up in small town centers as big box stores drove the downtown shops out of business. Downtown for many small towns is only one Walmart away from being destabilized.

And since I'm familiar with New York beyond Times Square, let me say that truly great urban areas have many, many retail centers and transit hubs. Just in Manhattan there's Union Square, Grand Central, Herald Square, Fulton Street, Columbus Circle, 86th street and Lex on the East side, 72nd & B'way on the West Side, 125th street in Harlem. Then there's dozens of satellite commercial and transportation hubs in the outer boroughs and Northern New Jersey, Westchester, Long Island and Connecticut. These major and minor hubs all work together to create the largest commuter rail network in the United States.

I used to have a five hour daily communte on that system from the CT shoreline, with a few connections along the way. The system is old and grimy, but in spite of this, I always liked the atmosphere. It was like walking back into the 1940's...and it is in fact a logistical wonder. I'd take it over a car commute any day.

I find it hard to believe that our in-town areas are all that different from the suburbs in the amount of energy use

In 1950, the US average SFR was just slightly over 1,000 sq ft (1,040 ?). And the shape was an energy efficient rectangular box (minimum surface area to volume).

In 2006, avg sq ft for a new SFR was just slightly less than 2,500 sq ft and the fashion was NOT a simple box, but complex shapes (more area to lose cool & heat). The # of SFRs/acre has dropped, reducing density.

Suburbs drive more than urban residents, even in Atlanta (from memory & visits).

Suburbs do have a lower % of multi-family housing (almost universal).

Suburbs take more energy to support water, sewer and electrical distribution (because of lower density).

Alan

California is setting the pace with SB 375. If local governments don't respond, the state can come in an set new land use rules. Local government is terrified of state mandates, so it is in their interest to act.

I doubt there is much that can be done about the problem of suburbia from the outside. When suburban living becomes unattractive for enough people then another form of housing will take its place. Just like the car allowed people to not have to live next to the blacks, hispanics, immigrants etc. One of the largest reasons for suburbia was overt and covert racism tightly coupled with keeping up with the the Jones's. Greed and hatred drove the white picket fence era.

The next factor was a real population growth from the baby boomer generation.

And last but not least government policies and banking rules heavily supported this expansion with loans for new homes handed out in a racially biased manner and tilted towards supporting a cartel of bankers and construction companies and large retailers.

As the small towns where gutted and the large cities descended into crime the suburbs actually became relatively better and the car papered over their intrinsic structural problems.

So the end of suburbia will happen when the real underlying support for its existence is overcome by other factors thats racism, greed and and expanding population.

Well the last one is east the baby boomer population is retiring. Generally families are smaller now 2 kids on average and a lot of people defer having children till later in life.

And last but not least the way schools are funded and voting for services has a huge influence but this is secondary and based on the demographic patters but it becomes a driving factor later.

Next as far as rascism population growth is ethnically diverse in most western countries and overt racism has waned.

Certainly its still a big factor but it power is significantly less in the age range of 20-40.

On the infrastructure side I'd say the biggest issue is that the large retailers need to fold I think that peak oil will play a large role here leveling the playing field as cost of transport overrides economies of scale and devaluation of the currency favors local production. This is a big one and probably the hardest to break.

Here the slowing economy will help a lot !

Cornucopians point out all kinds of schemes to save suburbia from EV's to small garden plots but underlying all the discussion I've seen on this board are the basic and intrinsic facts. First generally suburban homeowners are in the top income brackets thus they will be the last to be demand destructed based on oil prices and the first to be able to afford technical solutions to the oil price problem so they are not going to change based on this. Garden plots are a feel good measure and largely irrelevant.

What matters is that Suburbia is a ponzi scheme. Urban housing can readily be sold or rented the housing works quite well in either scenario. Suburban houses are poor chooses for rental units they are expensive. Thus suburbia is very dependent on a steady influx of new suckers buying into the the scheme. Its ownership based. Once alternatives become even slightly more attractive suburbia fails rapidly. Especially given our demographic changes of retiring baby boomers and that many of the potential new suburban home buyers are from "the others" immigrants on minorities people most Americans can't stand to be near. Spiraling fuel costs work indirectly to decrease the purchasing power of those interested in living in suburbia.

The bottom line is suburbia is poised to experience a ever spiraling deflation period as housing prices steadily decline this cannot support the underlying inflationary/longer term debt scheme that props up suburbia thus suburbia will fail.

And last but not least most people who have access to vibrant downtowns recognize that its actually very nice perception will shift as the larger retailers finally lose their advantage and downtowns are revived.

Agree or disagree but shifts and changes in housing patterns town livelyhood etc are based generally on some fairly basic migration patterns driving by some underlying factors. As these change the direction of movement changes the moment this happens the money flows into new directions and its a rapidly self reinforcing situation. If the money starts seriously flowing back into the city centers then that where the people will go.

My opinion is that peak oil again represents a secondary factor in the future of suburbia and just like I think it played a role in popping the housing bubble I think it plays a role in redirecting the flow of people back towards the city cores. Its secondary but omnipresent and it need not force a person into the core itself but if people choose closer on average more often then further out the direction has changed.

Whats funny is I think a force that most people would call a black swan is probably as important as the more obvious factors. Given that the next generation of property owners is racially and ethnically diverse they are going to desire to have stores that cater to their national and dietary backgrounds. These stores generally don't work in a mega-mall concept and they have tight overhead requirements. Certainly some will be in strip malls and they are generally in the poorer parts of town. As the downtowns revive I think we will see these stores and resturants move downtown and concentrate catering to the new diverse ethnic crowd. Thus although strange I think this is probably as important a factor as any that will eventually drive our communites to re-center.

If you look at demographics you see this sort of clustering is VERY common.

First of all, anything that emerges from the National Association of Realtors has to be taken with a grain of salt. The NAB is always on the 'sunny' side of the street with regards to housing growth, particularly detached, suburban tract housing. The NAB is a mouthpiece for the large, publicly traded house construction companies, the 'Home Builders'. That, after all, is where the money is.

As for what 'homebuyers' want ... well, they will want to have some food in their starving bellies as the current and future trends in the credit emergency play themselves out in Washington and on what is left of Wall Street. The person who does not have faith that Robert Rubin or Larry Summers represent any change from the stasis quo is very astute. Mr. Obama (or O'Bama, America's first Irish president) has been in government for exactly twelve years, holding elected public office in the Illinois state legislature and in the US Senate. He a) doesn't know anyone, and b) never took charge or exerted leadership with regard to any energy- or economic- related situation while he held those offices. He never held hearings, never subpoenaed witnesses, never investigated issues that were relevant except to take money from energy companies and vote for legislation favoring the energy companies. If O'Bama had to prove he actually was in the US Senate, he would have a tough time. He was the 'Shadow Senator'.

Now, we have a Shadow President. What does this mean?

It means a spirited defense of the stasis quo. Whatever Americans are used to ... will be oontinued into the future as long as Saudi Arabia and China are able and willing to buy our Treasuries. There will be more roads. There will be more subsidies of ethanol and for the light- water reactor nuclear industry. There will be subsidies for the US auto companies. There will be subsidies for the airlines. There will be capital improvements to build shopping centers, overpasses, parking garages, coil fired power plants. Shipping canals will be dredged, seawalls will be built, causeways and large highway bridges will be constructed ... The states and the Corp of Engineers have long lists of highway and maritime improvements that have been set aside as piece by piece approval has not allowed them to gain financing; some of these projects have languished for decades ... these will all be approved. The big contractors will take half of the money allotted off the top, subcontract the balance; that sub- contractor will do the same and the work will be done by tweny men with machines. More bridges/tunnels/locks/overpasses/intercounty connectors/parkways/parking garages will be built at ten times the actual cost and with no visible use or function other than to demonstrate the US government has lost its way and has surrendered itself to brain lock and corruption.

Oh yeah, there will be some tax breaks for solar panels and wind farms.

What will happen next?

-- The Fed will buy bonds that the Treasury Department sells and force the longer term bond rates lower. This is called 'quantitative easing' and is the same thing as creating inflation. The bond market will rise ... for awhile, as there will be a floor under bond prices. There is a bubble brewing in bonds and like the other bubbles, this one also will burst, taking the bond market ... and the dollar ... with it.

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aP5uFzsclsDQ

Jim Rogers is to commodities as Matt Simmons is to petroleum; he is worth paying attention to.

-- Another scenario that is possible is the Treasury will defaolt; it will suspend interest payment on a particular segment of US debt; this will cause a 'run' away from the dollar and turn the currency market into a version of the new car market.

This chart represents the Credit Default Swap spread on the US Ten Year bond, which is a speculation on default.

http://www.prudentbear.com/index.php/commentary/guestcommentary?art_id=1...

What is happening now in the US partcularly and in the rest of the world is the cause and consequences of credit revultion. Credit being the most sensitive part of the postmodern economic ecology. Whether Peak Credit does in the 'American Way of Life' before we even get to Peak Oil depends upon how lucky we are. Whether suburbia will survive this is an open question.

"Jim Rogers is to commodities as Matt Simmons is to petroleum; he is worth paying attention to."

Even Saint Simmons can make an ass of himself. I offer his remarks on CNBC on July 14, 2008. This was a day or so before oil peaked at $147. Paraphrasing Mr. Petroleum, he said oil was going higher, maybe way higher. The price was not going to collapse, there was no oil bubble, and so on. Google it, I am sure you can find videos and comments all over the web. "Experts" are often wrong especially when they let their belief systems crowd out that fact that oil is, was, and will always be a commodity that is subject to the laws of supply and demand.

"The dollar is ``going to lose its status as the world's reserve currency,''

That statement very well may be true. (Just as Paul Krugman's forecasting a recession every six months for the last five years is now true.) But how long before this happens and it may pass with a whimper rather than a bang. I was around when the US stopped settling balances with gold and citizens could start purchasing gold. Life on main street pretty much went on as usual.

At the moment, however, the dollar has been strengthening as the world economy weakens. I offer you this article for a good read on the dollar in today's Journal:

http://online.wsj.com/article/SB122860234998085639.html

"Since the start of August, the dollar has strengthened 23% against the euro, 34% against the British pound, and still more against some currencies in developing countries," and "Safe port in a storm" seems to make a lot of sense to world wide investors.

There are a lot of people that believe the recent run up in many commodities was the result of people doing exactly what Jim Rogers is preaching. "Investing" in commodities and, boy, that has certainly paid off well for them hasn't it?

You are old enough to remember when the premise of China controlling or dictating policy to the United States would have been considered science fiction. Yes, there are fluctuations, but so far the plan to have Robert Rubin run the USA hasn't been a roaring success for the nation.

Have you been paying attention to China's economic situation lately? China is not recession proof and is currently having massive layoffs and labor problems with all the unemployed factory, mine, and service workers. China is no position to "dictate" or "control" our economic policy. Their economic bailout, so far, is a much greater percent of GDP than any country. There have been recent articles in IBD and WSJ lately. Check them out. The notion of China dictating US economic policy, currently, is that of the person holding a gun to his head and saying, "You had better do so and such or I will blow my brains out and show you!"

It is hard to define 'confidence' or figure where it comes from, but when investors in credit default swaps (usually banks and hedge funds) act on the sense that the US Treasury will default (either the old fashioned way or by devaluation- by- monetizing) this should be taken seriously. The Treasury spread in spring of 2007 was around 2 basis points.

So ... how does one generate confidence?

- In 2007, the Fed balance sheet was $900 billion and all Treasuries. It is now $1.9 trillion and is all junk or worse. If the Fed's balance sheet was similar in extent to the 'good ol' days', the Fed could be accused of neglgence, but becoming the buyer of last resort for all kinds of crap indicates the Fed doesn't know or care or is bought off. Not a confidence builder ...

- The dollar is trading against currencies of countries that are also facing economic hardships. If the hardships continue, the dollar will trade strongly against them ... but is a world- wide recession/depression the price that must be paid for a strong dollar? How dos that inspire confidence?

- The incoming president has an economic team that includes the same people who created this mess in the first place! Where is Phil Gramm? I bet Obama has his phone number. If O'Bama had one decent economist rather than his museum collection of 'Powerful White Dudes', it might be possible to have some confidence in the government getting a handle on the situation. Right now Obama acts as if he doesn't know enough, which means he's not qualified, or he likes to watch people argue which means he is interested in winning elections but little else. How can either generate confidence?

- The incoming president refuses to tell the truth about US petroleum dependence. He's won the election already, he has nothing to lose! He either knows and is lying or he is ignorant and refuses to learn ... just like the millions of other 'Peak Oil Deniers' who populate suburbia. In either case he is not doing his constitutional duty to defend the country; he is already a sitting Senator and he has an obligation! How can this be a confidence builder?

- The level of corruption in business and government is profound. What is needed is a 'force'; an individual with fierce determinatioon and high competence to ferret out wrongdoers and put them in prison where they belong. Someone who can put the word 'honest' alongsode 'government' so that people don't laugh. Why not hard- hitting Andrew Cuomo as Attorney General rather than another Clinton hack? Eric Holder was easily bought off by Marc Rich. Having a corrupt Attorney General is hardly a confidence builder.

- The institutions that bought stock/bonds/commodities in order to 'keep the markets liquid' ... or some other rationalization for manipulating them ... have gone out of business (Lehman Brothers) or have no more credit (Citigroup). The Fed is the last remaining player and they still do (and have and will continue) to manipulate the bond market. Without 'pricing support' ... a floor under prices, the markets swing wildly. Commodities swing down today, swing upward tomorrow. As the market capitalizations shrink, smaller amounts of capital can have the effect of moving prices, in any direction to a very large degree. How can the market gyrations generate confidence ... in markets?

- The price relationship of supply and demand still works. The oncoming massive expansion of supply of Treasury securities will certainly affect price; it has to. If it didn't it would suggest market mechanisms are broken. If it does ... it suggests the Treasury is reckless. Neither condition is particularly inspiring. At the same time, the Fed will force prices higher by buying all Treasury bonds with counterfeit money; it will manipulate the market until it cannot do so any more. The charade will end, the resulting bond bubble with burst. Does this inspire confidence in the bond market, the Fed and the Treasury?

Trust and confidence are fleeing the market institutions. The US government is not immune from these forces. Unless confidence can be maintained in the government and its proxy - the dollar - investors will eventually refuse it in favor of other stores of wealth, be these commodities like gold or silver or petroleum or even raw land. It would be ironic if the value of real estate is, in the end supported by the collapse of the dollar.

What a confidence builder!

LIfe in main street is far from normal, today. It is the beginning of the recession, the effects of it on the dollar have not been felt, yet. When this happens it will be noticed on main street.

The first casulties of the credit problems are home loans and auto loans followed by credit cards and commercial real estate most of it malls, strip malls and suburban office buildings. This is the financial base of modern suburbia and its weakness is it cannot survive ever lower housing prices.

Worse housing is coming off a massive bubble so we are not talking about a 10% reduction not unusual in past recession but in many places a 50% drop just to get back to a generally sane price followed by a 20% drop in all probability as a result of the recession. This is a 70% drop in prices from peak prices over the next few years.

On top of this and starting is the demographic shift of baby boomers retiring most having lost a substantial amount of their investments many will opt to sell there homes to pay for retirement. Even with these huge price drops most would still make a substantial amount from less their homes. Or at least the first ones to sell will.

This could easily trigger and additional price decline of 5% vs peak values.

Next consider we should see with peak oil a effectively never ending deep recession aka depression with even higher unemployment this should shave 5-15% more off of home values as with a big factor being people moving in much denser

living condition to save money. Right now the US has a density of about 2.4 or so people per housing unit if this went to 3.4 or say increases by about 30% then we have about 30 million excess housing units.

If you read stories about the Great Depression on obvious theme was the number of people living in a home often doubled.

As you can see you quickly get a situation that the forces effecting suburbia lead to a potential decline in prices of over 100% this means of course that many housing units will eventually have no worth i.e they will go to zero.

And we have not even mentioned peak oil and spiraling transportation costs coupled with a rapid drop in the number of people who can afford new more fuel efficient cars or EV's. Expect automobile manufacturing to fall to a fraction of its current level inline with the decline in home prices.

And we have not even addressed taxes and keeping the massive road infrastructure viable under these conditions.

The bottom line is Americans are facing the results of decades of misallocation of resources with no recourse.

You can see that the real problem with suburbia is that it collapses in the face of a long recession/depression and

dwindling resource base. The primary problem is it is dependent on inflation and long term credit.

Garden plots are a feel good measure and largely irrelevant.

I agreed with most of your post except this point. 1/4 acre, as has been described earlier, could provide a substantial amount of food, assuming the soil is acceptable or amended so. Most gardens are not that large, and are mostly summer salad gardens. However, the potential should not be dismissed out of hand.

Obama announced this morning that he will be jump starting or applying paddles to the economy by spending billions of dollars on roads. At the same time, he has strongly advocated reducing oil dependence and fighting global warming. How many of these roads will just increase sprawl? How many of these roads won't exacerbate dependence upon the auto? Yes, we are in a crisis, but this is not the time to fund roads that make it even more difficult to deal with oil dependence and will encourage people to use their automobile. This will be one of the first things he does as President. I find that appalling unless his team plans to only pick roads with the least negative impact on oil and carbon emissions.

We are in an economic crisis and, in dealing with that crisis, should spend that money consistent with problems that will be with us long after this crisis is over. Of course, there are those who think that this is more part of the beginning of the long emergency rather than just the typical cyclical recession. Regardless, we need to be thinking forward ten, twenty, a hundred years rather than just the next election cycle. I am afraid this may not be change we can believe in. I think it may be part of the same old business as usual approach to economic problems. I hope I am wrong.

I don't think you are wrong on this one-how can you have "change" when every single advisor the guy has appointed is from the same old tired club? So far, it is remarkable how cautious the guy is, when he has a clear mandate to attempt to right the economic ship. It would be enlightening if Obama would publicly state why he feels Robert Rubin is qualified to be advising anyone on USA economic policy.

You need to understand that roads are what we build instead of stone heads.

Roads we build WNC says OR is it highways. Highways that detour around the small towns and leave them dying as a result. Or does leaving them dying for the better maybe?

But I have seen my small town try to emulate the rest by cutting down all the shade trees(keeps the town crews from having to maintain them),paving over every older house they try to tear down(even ones that are very well built) and trying to engage yuppie smary shoppes (which never never happen BTW) and then raising taxes again and again.

Finally they move the courthouse way off and the schools go way way out in the county. So the town is dead,dead and still dying and they can't get a frigging clue for their heads can't see well out of their sphintcher musclature.

The townie council is padded out with those who are shortsighted and very low on the Bell Curve.

Town is then totaled out. No help in the forseeable future. The shops that were there are lost.

It takes real smarts to do it right. Politics and nepotism figure in greatly.

I speak here of small country towns. And on top of that the local feed mills shut down long long ago because the 'big boys' drove them out of bizness.

IMO N. Carolina does some small towns real well. Well around Raleigh though it is a wasteland. Take a look at Cary then. It was once a very nice small town. Northerners I think ruined it for good.

I was there last winter and so different from when I lived there in the 70s that i had to use a GPS to get around in it.

Yes success(?) has ruined many places(and Rock Hudson as well) IMO. Now they will die slowly from overbuilding and massive sprawl.

Airdale-small town Murkah is still dying

I don't know if he specifically said a percentage of spending would be on NEW roads and bridges. Every state in the union has bridges that need immediate repairs. Many existing roads are in poor shape. State budgets have largely ignored road and bridge maintenance for years in order to focus on other budget priorities. Let's see where the money is allocated before jumping to conclusions.

What about the future home buyers?

Families with small children, the traditional target market, will decline greatly as a share of homebuyers. Baby boomers, empty nesters, will dominate. There is plenty of unsold homes to meet demand for detached, single family so few additional will be built. New construction will shift to walkable and multi-unit.

Ask the guys at Toll Bros.

New construction will shift to walkable and multi-unit.

How many more units should we build - that is - what should we look to increase our population to? Would 400 million be a good place to stabilize or would we see more benefits from a population at 500 million? If we are going to 500 million and above it would probably be good to only build high rise condos/apartments of 100 floors or more from here on out. That way you won't even need to walk to stores. You will be able to take the elevator.

One of the reasons for the move to detached housing not mentioned here, which is obvious to anyone who has lived in old terraced, semi-detached houses or flats in older buildings, is noise. The structures transfer noise usually the deeper notes.

My neighbour in a house I owned years ago had the misfortune to have his living room on the otherside of the wall from our toilet! At the very least he could hear the flush.

Noise generated by others can be stressful.

From my limited experience of US towns I would say the first thing you need to concentrate on is pavements or sidewalks, even in tourist areas they can be terrible. All the europeans go out for a walk in the evenings but after the first night you realise there is no point and get in the car for 300 yards.

In retail parks you cannot walk from unit to unit without a machete to beat back the bushes and the roads in the US are so wide you need to install pedastrian refuges in the middle of the roads. Start with simple changes because they are cheap but can have big affects.

mccymru,

Two good points, footpaths can be designed to work well with bicycle paths. It's essential to have either tunnels, footbridges, or pedestrian lights so that you can actually travel more than one block. It also helps to have a separation between road and footpath to reduce noise, and vehicle hazards. This could be a great way to quickly create jobs.

Closing off shopping districts to through traffic also makes footpaths much safer.

Noise in high density living situations can only be solved by improved building codes. Improved insulation, double glazing also helps to reduce both noise and energy use but it's going to take many decades to fix.

People will respond to cost. An increase in electricity prices would cause people to balance R-60 insulation and U-0.18 windows against an extra 500 sq ft of mcmansion space.

An announcement that the federal gas tax would be increasing by $0.0x per month for the next 20 years would establish the same mindset in housing and transport.

I'm sure this is what they told the surveyors to make themselves feel better. In reality they spent the extra money on countertops and cabinets while settling for the SEER-13 air conditioner.

If you are buying a spec home (most homes, really), you don't have much of a choice. The builder offers you a menu to choose from and you pick from that. The list will likely have countertop and appliance upgrades, but not HVAC or insulation upgrades..

Environmentally friendly features also were important, cited by 90 percent of buyers.

Just two years ago, the Real Estate section of the Phoenix paper said exactly the opposite. Energy efficiency had very limited market appeal (a niche for a small % of buyers), while granite countertops et al were what the market wanted.

Alan

Well, there is what people say they want, and then what they go and buy. For example, I have seen a few people buy houses at auction. They mouth some greenish platitudes. They might have won the auction at say $350,000, but have been willing to bid up to $370,000. Yet once the home is bought, they are unwilling to spend $4,000 on a subsidised solar PV system.

"Another $20,000 to get the house?"

"I can afford that."

"$4,000 on solar PV?"

"I can't afford that."

So very probably when surveyed the people said they would happily pay for "environmentally friendly features". But when it came down to it, they wouldn't spend the cash.

Also it could be the way the question was framed.

"Would you pay for environmentally friendly features?"

"Yes." Who's going to say no? That's saying that "I am not friendly to the environment."

"Would you pay $4,000 for solar PV, $3,000 for insulation, $2,000 for rainwater tanks, $3,000 for double-glazing the windows, and $6,000 for energy-efficient appliances?"

"Um... maybe."

"How about $3,000 for a plasma screen tv?"

"Sure! Those are awesome."

They might be thinking of what they could resell those same features for.

And, unfortunately, that attitude is exactly right. Our ethos has to change first.

Even with the right "ethos", we may still not see that kind of investment. Other things come first, like paying off debts.

We've recently bought a home - a two bedroom unit with small courtyard in a suburban area 1.3km from train line, 600m from shops etc - and have faced similar sorts of issues.

Here's offered a first home buyer's grant. Basically this covers the taxes associated with a new home, plus a few thousand. I suggested that few thousand ought to be invested in some solar PV - a grid-connected 1kW unit could generate 1,825kWh annually (which is about what we consume) for $4,000 - or a water tank for garden and laundry water at about $3,000 altogether, or a solar hot water system for a couple thousand. I suggested that to balance the expense, a thousand or so might be made by removing the existing 2.4kW aircon unit.

However, we simply don't know if it'll improve the value of our home. "Energy efficient" or "has grid-connected solar" just isn't something that appears in real estate advertisements. Now, the value of the place isn't very important to us in the next decade while we're likely to be living in it, but each dollar we put on improving the place is a dollar less we could be putting on the mortgage. And we're keen to be out of debt asap.

In the meantime we have to be content with simply conserving energy and water, and buying wind-derived power from the retailer.

So while we're never going to buy a $3,000 plasma screen tv, still we don't spend on this sort of stuff. We do things to reduce our dependence on coal, oil and gas which don't require extra spending overall, or which save us money. We are not masters of carbon reduction, only journeymen.

I believe the United States has a window of opportunity to reap environmental, economic, and national security benefits from a multiyear tax on gasoline. I understand that in the midst of this recession we are trying to pump money into the economy to stimulate investment and employment and taxing people seems to be counterintuitive. But there are so many benefits to this action and the political context may never be as favorable as right now.

Despite the severe economic downturn that Americans are experiencing, one can almost sense the collective sigh of relief on America’s roadways. When gasoline hit $4.09 per gallon nationally in early July, Americans could probably never imagine that we would currently have gasoline prices under $2 per gallon. Yet, many people correctly realize that the current decline in gasoline prices is only temporary.

Even though the entire world will experience some form of an economic slowdown, global economic activity will eventually pick up led by the emerging economies in Asia and Latin America. Their thirst for oil and gasoline will only exert upward pressure on crude oil prices and eventually our increasing reliance on imported oil will make us vulnerable again.

As a society, if we were willing to look ahead and sacrifice for the future, we would support a gradual, multiyear increase in federal gasoline taxes. An increase of 10 cents per year for ten years seems affordable with some of the revenues going into the highway trust fund for the repair of roads and bridges and some used to create an alternative energy trust fund to finance wind, solar, or even help automakers produce compressed natural gas vehicles. Congress could make sure that many alternatives receive funding. This way, competition would keep a lid on price increases for any one alternative. We could distribute the money to the states (maybe each state should get the same percentage revenue it generates in gas tax collections) and let them decide which type of alternative energy source makes sense for that state.

Imagine the benefits of extra billions in capital every year! Employment in alternative energy industries would soar. We would reduce our “carbon footprint” significantly. We would more steadily pressure Russia, Iran, and Venezuela to avoid risky foreign adventures. In fact, speculators would stay out of the oil markets knowing the world’s largest oil consumer was determined to lower its demand. In this way wholesale oil prices would remain lower and we would feel less impact from the increased taxes.

We probably should initially exempt diesel fuel from the new taxes because of its impact on truck drivers and the cost of basic goods like food. Using some of the new tax revenues to support a new trucking fleet based on compressed natural gas, which burns cleaner than gasoline and is more widely available domestically, would further enhance employment and energy security. We could phase in the tax on diesel more slowly.

Finally, for those who chant “drill, baby, drill,” and think that domestic offshore drilling is the answer to our problems, how many oil companies are going to employ the capital needed to drill in deepwater and other expensive, hard-to-reach fields with gasoline under $2 per gallon? Many unconventional oil projects from Canada to Asia and Africa have been postponed in the last six months due to lower oil prices Do you think Americans are going to buy American-made small cars with gasoline under $2 per gallon. What are the prospects for a return on the bailout of the auto companies under these circumstances? It would be rather foolish of us to bail out the auto companies only to have Americans shun fuel-efficient cars because of low gasoline prices.

Now is a very propitious time to enact this measure. A very large stimulus package is about to get passed and there is an urgency about improving the economy. Why not enact a multiyear gas tax as part of a package? It could be sold as part of a down payment on paying off the debt from the stimulus and a gasoline tax would subsidize the types of spending going into the stimulus. Americans would hardly notice a small increase in the gasoline tax at this point, especially if it took effect on January 1, 2010 when the economy should be more stable. Are we going to wait until the economy starts growing again and the urgency is gone and the dramatic decrease in gasoline prices has worn off?

The big question is whether America is up to the task. The new administration will have to act decisively and creatively to avoid a severe recession in 2009. Similarly, will we support bold and innovative ideas to secure our energy future? Will we have the attention span to “keep our eye on the ball” now that gasoline prices are much lower? Will we be smart and start to wean ourselves more aggressively away from an oil-dependent transportation system? Or will we wait until the next run-up in oil and gasoline prices and then whine and complain when it is clear we have very little control over our destiny and we are even more vulnerable to OPEC and Russia?

That's a good reason not to delay the tax. We need to promote both local production and a shift from trucks on highways to rail, and electrification of rail. Using tax policy to delay the incentives for these things is counterproductive.

I have to Strongy Agree that the only market based way to make changes in land use and improve our imports situation is with oil related taxes, particularly a fuel tax.

We have an excellent opportunity to implement an incremental energy tax while oil prices are low. And the really cool thing is: "If energy taxes are sucessful, they will keep oil prices low for some time to come!" Even in the face of growing world demand and shrinking supply.

Economically speaking I don't believe we have any other choice. An energy tax would reduce suburban sprawl, force auto manufacturers to provide higher milage vehicles, force builders to build more energy efficient homes an offices. All just in time hopefully to weather the relentless onslaught of growing energy costs when oil demand significantly exceeds supply.

How can we fairly do this? Take the Fuel Tax for instance: A Quarter a Quarter. Raise the fuel tax 25 cents every 3 months for at least the next 5 years. Offset these increases by corresponding cuts in the income tax for everyone. For low income earners, additionally subsidize the social security and medicaid taxes in order to prevent the Quarter a Quarter plan from being too regressive. Also, divert a good chunk of this new revenue toward more expansive mass transit. More runs more often and with a wider reach. No one will use a mass transit system that doesn't provide a means of getting to a large percentage of the places folks need to get to.

I believe this is possible and will be very good for the country. How to convince others this is so seems daunting.